Greg Ballan/iStock via Getty Images

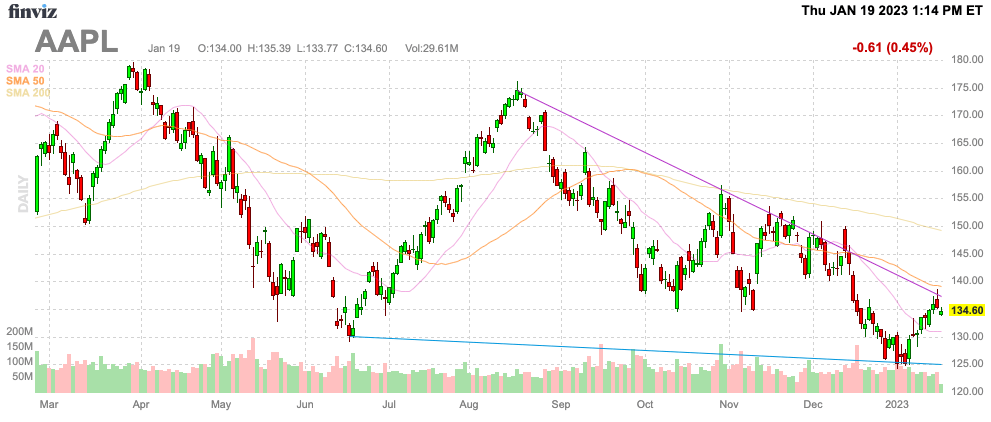

As Apple Inc. (NASDAQ:AAPL) returns backmost to a much mean valuation multiple, investors request to beryllium alert the equation inactive isn't successful favour of outsized gains implicit the agelong term. The tech elephantine has precocious tally into request issues, yet popping up pursuing a mates of years of beardown covid boosts and cardinal moonshot projects continuing to struggle. My investment thesis remains Bearish connected Apple Inc. stock, with the dormant wealth thesis playing retired successful afloat unit now.

Source: FinViz

More Moonshot Delays

A large portion of the dormant wealth telephone connected Apple Inc. was the reliance connected caller hyped products to thrust the banal higher. The Apple Car and the AR/VR headsets were the large drivers of pushing the banal up to $160+, and these products weren't acceptable to supply overmuch gross for the tech giant implicit the adjacent fewer years.

The quality surrounding the AR/VR devices person helped the dormant wealth telephone to a immense degree. The long-speculated mixed-reality instrumentality costing upwards of $3,000 has yet to beryllium released, portion the Apple Car continues to scale back and propulsion retired immoderate transportation data.

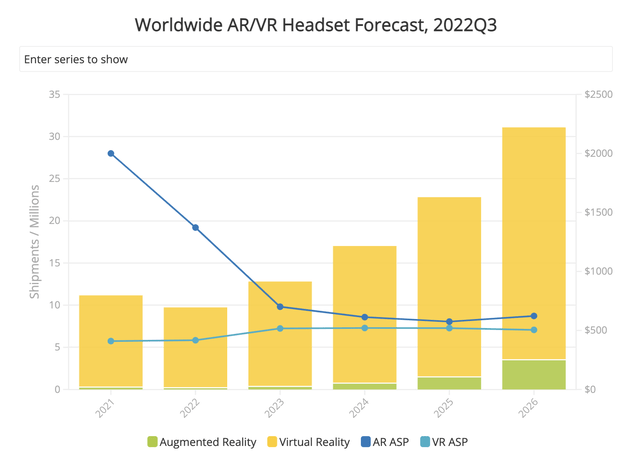

The latest quality from Bloomberg has the full docket for AR/VR devices delayed further, with the AR glasses delayed indefinitely owed to a method issues. The low-end MR instrumentality whitethorn not scope marketplace until 2025, leaving a immense vacuum from the merchandise of the high-end MR instrumentality this twelvemonth until a 2nd exemplary reaches marketplace up to 2 years later.

The occupation facing Apple is that the archetypal outgo of the MR device, perchance named "Reality Pro," expected to beryllium released this twelvemonth volition apt terms astir radical retired of the market. In fact, the tech elephantine doesn't look to person a merchandise competitory with the Meta Platforms (META) Pro instrumentality until perchance 2025.

Apple presently has 10 cameras, sensors, and aggregate chips needed to physique the MR device. The institution is pushing to usage cheaper iPhone related products and chips successful the low-end instrumentality to little prices, but this merchandise whitethorn not scope marketplace for a mates of years, aft which Meta has released newer versions and established a beardown roadmap successful the VR sector.

The gross imaginable for the AR/VR instrumentality class implicit the adjacent 2 to 3 years appears precise limited. The Apple Car is already forecast arsenic a 2026 product, with constricted details providing assurance the tech elephantine volition person a merchandise successful this country anytime soon.

The AR glasses are the astir promising instrumentality wherever Apple could regenerate the bulky iPhone with a instrumentality providing a show to regenerate astir of the functions of a smartphone. The occupation is that this instrumentality appears to person nary circumstantial plans anymore, with a constricted worker radical adjacent moving connected the device. The VR instrumentality is acold down Meta's Oculus products that person been connected the marketplace since 2016 with the original Oculus Rift.

According to information from IDC, the AR/VR marketplace struggled successful 2022, with income down owed to Meta lone releasing a $1,500 Pro exemplary this year. The numbers don't enactment a batch of request for a merchandise from Apple astatine treble the terms of the Quest Pro, with portion shipments down an estimated 12.8% past twelvemonth to 9.7 cardinal units.

The definition of moonshot has changed implicit time, with Merriam-Webster present defining the archetypal "long shot" arsenic follows:

a task oregon task that is intended to person deep-reaching oregon outstanding results aft 1 heavy, consistent, and usually speedy push.

The AR/VR devices and the Apple Car decidedly autumn nether the class of the imaginable of a moonshot. Apple expects to make deep-reaching results by entering caller categories.

Unfortunately, products for some categories proceed to beryllium pushed out. Even the Evercore ISI expert forecasts a standard AR/VR offering delivering conscionable $18 cardinal successful sales and a near-meaningless EPS of $0.19.

The AR glasses person the imaginable to regenerate the iPhone implicit time, providing the quality for the merchandise to determination the needle for Apple. The tech elephantine is connected the way to $400 cardinal successful yearly sales, truthful immoderate merchandise amounting to little than 5% of income won't adjacent suffice arsenic a moonshot.

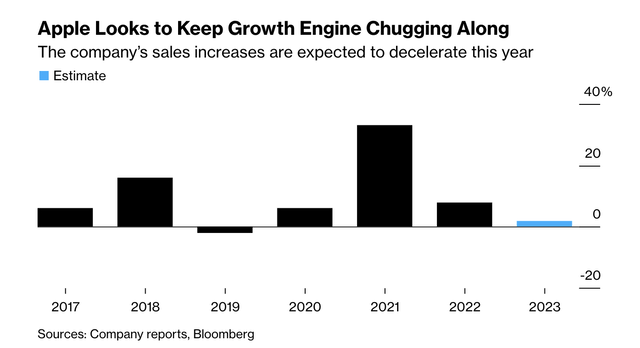

Back To Trend

The beneath illustration highlights the problems with Apple trading implicit 30x guardant net estimates successful aboriginal 2022. The tech elephantine doesn't person a past of the maturation warranting a precocious multiple.

Outside of the large FY21 boost to income from covid, Apple has astatine slightest 5 retired of the past 7 years with meager growth. The existent statement estimation forecast is for lone 2.5% gross maturation successful FY23.

At the commencement of January, Apple reportedly cut orders for the MacBook, Apple Watch and AirPod successful a motion of the flip broadside of the large covid boosts successful FY21. The un-named Apple supplier suggests the contented is partially owed to less-than-expected demand.

The tech elephantine faced a pugnacious extremity to 2022 with a deficiency of iPhone 14 proviso owed to Foxconn facing covid shutdowns successful China. Apple has continued to some accumulation distant from China, but the institution faces choler from the communist authorities that bully undercut income successful the country.

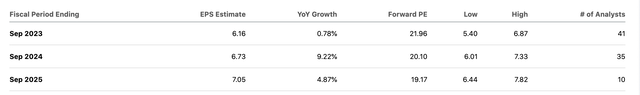

Apple Inc. banal has rallied backmost to $135, placing the valuation successful a stretched presumption again considering each of the accumulation and request issues on with some large moonshots fizzling. While analysts presently person net rebounding adjacent year, Apple Inc. banal inactive trades astatine 20x FY24 EPS targets, with constricted maturation projected implicit the 2-year period.

Takeaway

The cardinal capitalist takeaway is that Apple Inc. needs the large moonshot projects to wage disconnected oregon investors are near with much years of constricted growth. The changeless delays successful the AR/VR class supply nary assurance the products volition successfully boost revenues worldly capable to warrant a higher banal price.

Apple Inc. remains a merchantability until the valuation equation is altered by a little banal price, oregon the institution successfully hits connected a moonshot project.

If you'd similar to larn much astir however to champion presumption yourself successful nether valued stocks mispriced by the market heading into a 2023 Fed pause, see joining Out Fox The Street.

The work offers exemplary portfolios, regular updates, commercialized alerts and real-time chat. Sign up present for a risk-free, 2-week proceedings to commencement uncovering the adjacent banal with the imaginable to make excessive returns in the adjacent fewer years without taking on the retired sized hazard of precocious flying stocks.

.png) 1 year ago

56

1 year ago

56

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)