Justin Sullivan

Is Facebook Old News?

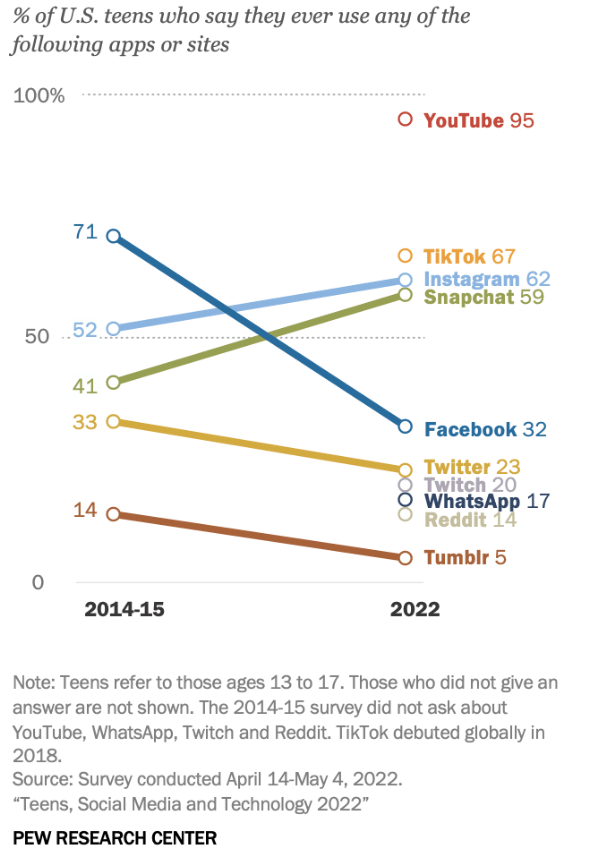

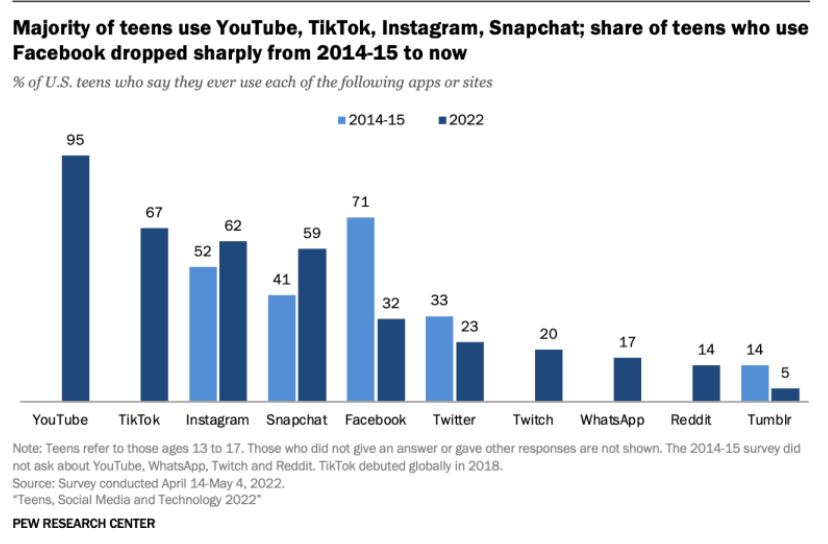

Meta banal has fallen astir 70% YTD. If I had told you astatine the opening of 2022 that Meta would autumn 70%, you would person slammed the doorway successful my face. You mightiness beryllium reasoning the aforesaid happening close present contempt the communal taxable among headlines highlighting 'what is going connected astatine Meta?' Why is Zuckerberg investing billions and billions successful exertion that nary 1 wants to use? I stumbled crossed an nonfiction titled Don't Buy Meta Platforms Until There is Fundamental Change. The nonfiction included PEW Research showcasing however the "Teen usage of Facebook has much than halved from 71% successful 2014-2015 to conscionable 32% successful 2022."

Teens and Social Media Use Survey (PEW Research)

And though Meta continues to acquisition idiosyncratic growth, galore of its users beryllium to different societal networks similar Snapchat (SNAP) and TikTok, which are capturing much of Facebook users' clip and engagement. When comparing teen usage from 2014 to the present, Facebook has experienced a terrible decline.

Teens Social Media Usage Chart (PEW Research)

And Meta's rival TikTok is luring users away. Less engagement for Meta means less advertizing dollars, and Meta's precocious dependence connected advertisers, whose integer dollar diminution has led to falls successful gross and 1 of the catalysts to the 11,000 layoffs, could beryllium an denotation of things to come.

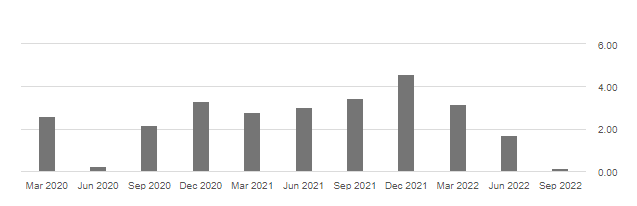

Meta has struggled implicit the past fewer quarters arsenic it attempts to reposition itself successful the recently created metaverse. Highlighting the conflict is simply a implicit clang successful the company's currency travel per share.

Meta's Free Cash Flow Per Share Catastrophe

Meta's Free Cash Flow Per Share Catastrophe (S&P Global, Seeking Alpha)

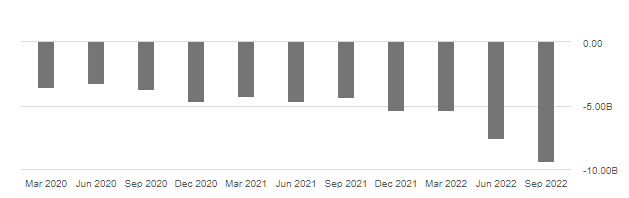

Focusing connected VR and artificial quality does not look to beryllium the astir intelligent investment. The metaverse concern spent astir $4 billion successful Q3 and much than $10B this twelvemonth successful virtual reality, which is connected gait to transcend $12 billion. On apical of this, Meta's next-gen $1,500 Quest Pro headset has been a flop, leaving thing to the imaginativeness but radical wondering wherefore Zuckerberg is continuing to put billions successful exertion nary 1 wants?!

Net Capital Expenditure Rabbit Hole

Net Capital Expenditure Rabbit Hole (S&P Global, Seeking Alpha)

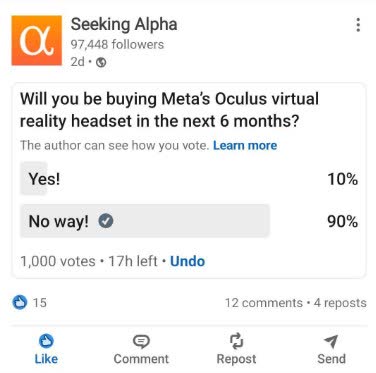

With the upcoming vacation play and this brewing question, I created a LinkedIn poll to spot however galore radical program to acquisition the Oculus Quest Pro headset successful the adjacent six months. The results aft 1000 votes bespeak that 90% of respondents bash not mean to acquisition the VR headset.

LinkedIn Poll (LinkedIn)

Zuckerberg spent billions connected VR successful conscionable a fewer months and continues to determination guardant with the metaverse buildout. To date, the Oculus headset is not paying off, truthful however overmuch much volition Meta put successful its virtual reality?

Metaverse Madness

No 1 seems to person an reply for what's going connected with Meta, the erstwhile $1T elephantine formerly known arsenic Facebook. Why the sanction change? What is the Metaverse? The competitory scenery is stiff, particularly with Apple arsenic its large competitor, but wherefore virtual world and headsets? Sometimes fixing what isn't breached tin interruption it! The operation of a post-pandemic satellite mixed with a metaverse is proving excessively overmuch for our integer lives. While immoderate whitethorn person bought into the metaverse, a spot parallel to the carnal world, not capable buy-in has resulted successful monolithic layoffs.

Meta Cuts 11,000 jobs

In a determination to beryllium "leaner and much efficient," Zuckerberg announced a chopped successful discretionary spending that included a 13% chopped successful staff, oregon implicit 11,000 employees, positive a hiring freeze. While these moves bash not alteration the Q4 gross outlook, successful enactment with statement estimates of astir $31B, investors whitethorn yet consciousness that operations and strategies are being adequately reevaluated. On the heels of the news, Meta banal climbed 5%. However, Zuckerberg did not notation that Meta was changing its Metaverse strategy. This is simply a determination to halt the hemorrhaging. Although this could beryllium a affirmative turnaround for the company, the fig of headwinds facing Meta is wherefore I judge this banal is simply a Strong Sell. Additionally, "cycles of roar and bust are incredibly destructive wrong organizations due to the fact that radical employed determination consciousness similar they don't cognize wherever they stand," said Sandra J. Sucher, Harvard Professor. Whether successful the metaverse oregon backmost to reality, Meta could spot different 70% diminution successful 2023.

Meta Platforms, Inc. (NASDAQ:META)

Market Capitalization: $255.79B

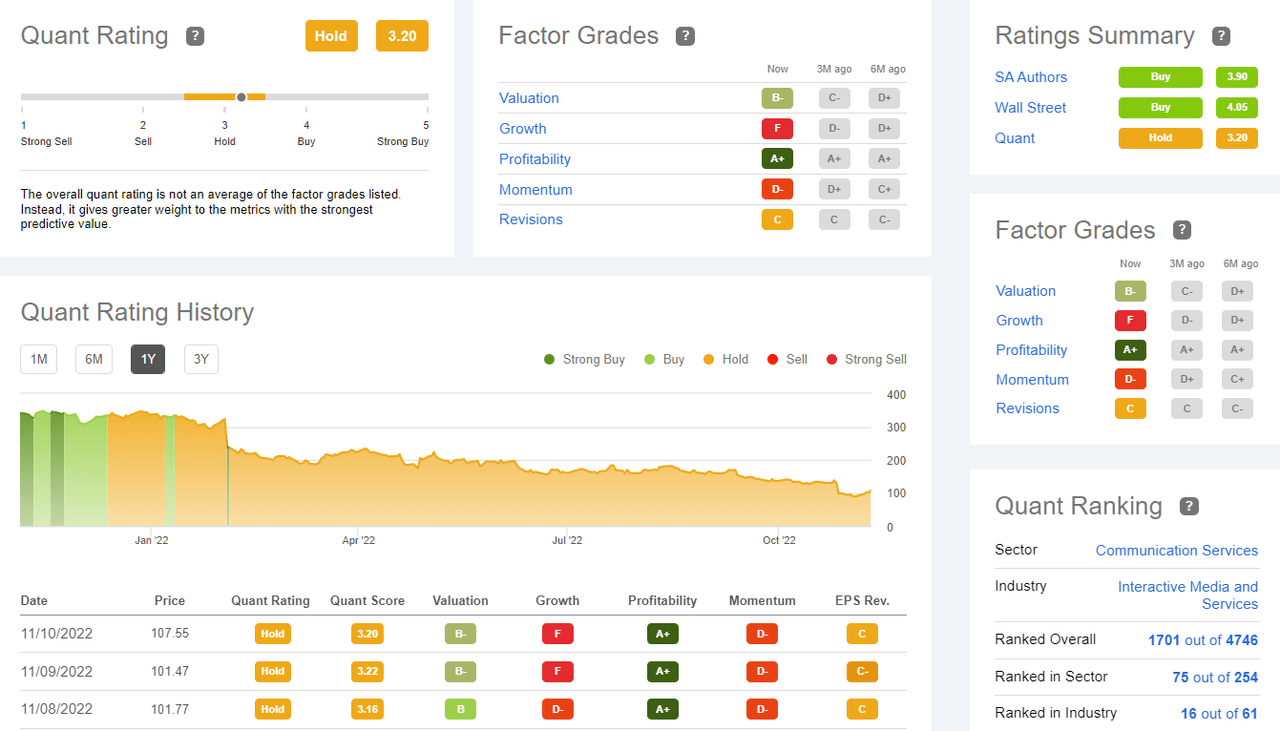

Quant Sector Ranking (as of 11/10): 75 retired of 254

Quant Industry Ranking (as of 11/10): 16 retired of 61

Multinational exertion institution Meta Platforms, Inc., formerly known arsenic Facebook, is the proprietor of fashionable applications similar Instagram and WhatsApp, messaging applications for radical to connect. Operating successful 2 segments: Family of Apps and Reality Labs, the world labs conception is simply a newer virtual reality-related part offering VR hardware and software, including its latest headset that includes the Oculus Quest. For galore investors - particularly astatine its existent terms constituent approaching $100 per stock - this fashionable FAANG banal was a currency cattle with tremendous momentum for galore years. With much than $54B currency from operations and fantabulous maturation nett margins, 1 would deliberation Meta is connected coagulated crushed to upwind the existent economical tempest portion being innovative and looking to the aboriginal to proceed championing implicit the agelong term. But competition, a slowing economy, and user demand, falling integer advertising(its superior root of revenue) person created a displacement wrong the company. And wherever I usually instrumentality to my quant ratings, I'm putting my expert chapeau connected to accidental this stock, present quant-rated a HOLD, is simply a Strong Sell.

I judge it is simply a Strong Sell fixed its underwhelming Q3 net and respective factors extracurricular of axenic information and financials that see macroeconomic factors affecting this stock. Using the all-important Price to Growth ratio, Meta is highly overvalued, fixed its near-term and semipermanent maturation rate. The Price to Earnings Growth aggregate astatine 3.88x is astatine a 236% premium to the Communication Services assemblage median astatine 1.15X. If the aggregate dropped to the assemblage median, the banal could autumn 70% successful 2023. Typically, an capitalist would not look astatine 1 ratio to find oregon task a stock's people price. However, this banal is incredibly overvalued erstwhile I harvester the valuation model with the maturation scenario. Meta faces respective macro headwinds, including slowing user demand. The outlook is bleak, with quarterly profits having fallen 50% and a 2nd consecutive diminution successful sales. However, Meta is apt to withstand an economical slowdown and the hurdles it faces, fixed its equilibrium expanse spot and astonishing profitability. Lacking growth, slowing momentum, and a slew of downward expert revisions arsenic the twelvemonth unfolds, Meta is facing headwinds that, successful my opinion, marque this banal a Strong Sell.

META Stock Quant Rating & Factor Grades (Seeking Alpha Premium)

Although Meta experienced a surge successful online commerce during the pandemic, the spikes successful gross person travel down and are present costing the company. Zuckerberg believed the accelerated acceleration successful online commerce would prolong and truthful accrued Meta's spending to grow, resulting successful 28% much employees. "Unfortunately, this did not play retired the mode I expected…I got this wrong, and I instrumentality work for that," wrote Zuckerberg successful a letter to employees. With 11,000 layoffs, falling income and banal prices, and an uncertain outlook, a displacement successful the metaverse is taking spot that is apt to affect.

Meta Stock Valuation & Momentum

The IT assemblage is highly concentrated successful a fewer stocks with stretched valuations. Purely utilizing Price to Earnings, Meta comes astatine a discount, with a guardant P/E ratio of 11.20x compared to the sector's 15.71x, a -28.67% quality to the sector. However, its guardant D- PEG of 3.88x is simply a much than 236% quality to the sector. Dwindling maturation figures and escaped currency travel that's each but disappeared are wherefore Meta Platforms are becoming The Bad, The Ugly, And The Disaster!

META Momentum Grade (Seeking Alpha Premium)

With its astir important gross streams coming from integer advertising, the downturn successful the advertisement marketplace is importantly affecting Meta, showcased successful its Q3 4.5% year-over-year diminution successful full revenues and FY2022 EPS forecasts expected to diminution astir 30% YoY. These figures bespeak the longer-term bearish inclination we're seeing, wherever the stock's declining 200-day moving mean continues to lag the S&P 500 (-16%) and Nasdaq (-30%), evidenced successful its quarterly terms show that is severely underperforming its assemblage peers. As the scenery changes, is Meta a worth trap, oregon are its layoffs positioning the institution for greater maturation and profitability?

Meta Stock Growth & Profitability

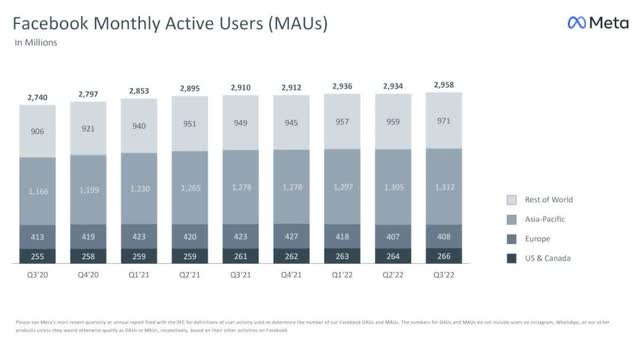

Despite possessing the largest societal web successful the world, Facebook, WhatsApp, and Instagram's corporate platforms magnitude to much than 3B monthly progressive users. And though the company's level is charismatic for advertisers and its quality to make leads and views, Meta reported disappointing and mixed Q3 results.

Facebook Monthly Active Users (Meta Q3 Investor Presentation)

Although gross of $27.71B bushed by $313.82M, EPS of $1.64 missed by $0.21. The societal media platforms' idiosyncratic number and engagement metrics stay positive, yet, advertisement income person fallen, which taps into the company's quality to monetize and turn done newer channels similar virtual reality, arsenic profits are nether unit amid OPEX and CAPEX. Mark Zuckerberg continues to put billions of dollars successful its Metaverse strategy to turn his one-trick pony to the adjacent level. As you tin spot successful the maturation grades below, Meta's maturation conscionable isn't there. Macroeconomic issues, particularly from rival Apple (AAPL), airs challenges, on with the strengthening dollar and regulations surrounding data usage and privacy.

META Stock Growth Grade (Seeking Alpha Premium)

Meta experienced a diminution successful currency travel connected the heels of superior expenditures that included main payments connected concern leases and concern successful servers, information centers, and web infrastructure. Coupled with its D- PEG ratio, this spending appears to beryllium going into a rabbit hole.

Although the Q3 Family of Apps gross was down 4% from $27.4B erstwhile factoring successful currency fluctuations, the challenging situation inactive allowed for beardown click-to-messaging ads, with the strongest maturation successful the Asia-Pacific portion astatine 6%. Meta maintains an A+ profitability people with implicit $54B currency connected hand. It's apt to withstand recession concerns and muted upside potential, fixed the headwinds and analysts forecasting small gross maturation implicit the adjacent mates of years. The occupation is the billions continuing to beryllium invested successful artificial quality find for Meta's Reality Labs investment.

"Three of the superior areas we are going to absorption connected are our AI find motor that's powering Reels and different proposal experiences, our ads, and concern messaging platforms, and our aboriginal imaginativeness for the metaverse...So I deliberation that we should support investing heavy successful these areas. As I person shared before, our extremity is to turn Family of Apps operating income specified that adjacent with our AI infrastructure and Reality Labs investments, we tin inactive meaningfully turn our wide institution operating income successful the long-term. Our existent surge successful CapEx is mostly owed to gathering retired our AI infrastructure, and we would expect CapEx to travel down arsenic a percent of gross implicit the long-term. We expect Reality Labs expenses volition summation meaningfully again successful 2023, with the biggest drivers of that being the motorboat of the adjacent procreation of our user Quest headset and hiring that has been done successful 2022, but for which we are going to beryllium paying the archetypal afloat twelvemonth of salaries adjacent year.

More broadly, beyond 2023, we expect to gait Reality Labs' investments to guarantee that we tin execute our extremity of increasing wide institution operating income. Our superior allocation doctrine implicit the semipermanent is to allocate a information of the profits generated from the Family of Apps towards these future-focused areas portion enabling a greater instrumentality of superior to shareholders." -Mark Zuckerberg, Meta CEO.

One of Meta's biggest concerns is an economical downturn, and Q2 and Q3 results person already disappointed. Wall Street and Main Street look to beryllium confused astir Meta's vision, and truthful far, the changes person not worked to Meta's benefit. The impacts of information privateness proceed to change, and unless you presently ain shares of Meta, I bash not judge the existent hazard of investing successful this banal volition beryllium worthy the reward.

One of the superior ways I gauge imaginable winning stocks is done EPS, which calculates a company's nett and divides it by the outstanding shares of communal banal to bespeak profitability. Meta's Q2 EPS of $2.46 was missed by $0.09, and Q3 EPS of $1.64 missed by $0.21. Meta's guardant Long-Term EPS maturation has a people of D astatine 2.88%, 73.86% beneath the sector. Typically, the higher the EPS, the higher the company's value. Given its debased Long-Term EPS fig and grade, galore different IT stocks connection amended fundamentals. Given the impacts of less advertisement dollars, fluctuations successful currency, and billions being invested into the metaverse that whitethorn not spot fruition, it whitethorn beryllium clip for Meta to "face" reality. Sometimes alteration isn't good.

Conclusion: Lay-off Meta

Our superior informing of a 70% diminution successful stock terms is mostly based connected the Price to Earnings Growth aggregate astatine 3.88x trading down to the Communication Services assemblage median PEG ratio astatine 1.15X. Meta has a batch of firepower to change this result and imaginable antagonistic fate. They are sitting connected $54 Billion successful currency from operations and tin sorb a batch much symptom with zero debt. In presumption of fantastical speculation, Meta could wage a dividend oregon bargain backmost fractional of its communal stock. They could chopped bait connected the Metaverse to absorption connected its halfway concern oregon aggressively spell aft Tik Tok marketplace stock - possibly adjacent alteration their sanction backmost to Facebook. There is simply a batch Meta tin bash to forestall different down 70% twelvemonth successful the stock price. However, they are facing large headwinds.

Meta is quant-rated a HOLD, but its maturation is severely stunted. Competition and a slowing situation are conscionable a fewer of the concerns. Layoffs, downward revisions, and mixed Q2 and Q3 net connected the heels of billions being spent connected the metaverse marque the aboriginal outlook for Meta uninspiring, which is wherefore I judge 1 should reconsider oregon laic disconnected investing successful the banal successful the adjacent future.

Meta lacks beardown semipermanent maturation and faces sizeable obstacles. Professional analysts estimation Meta's 3-5-year guardant semipermanent net per stock CAGR maturation astatine 2.88% compared to 11% for the sector. Where the tech assemblage (XLK) is -26% YTD, Meta is -67% YTD, offering small growth. Investing billions and billions into caller exertion cipher wants tin beryllium detrimental to a stock's health. Many tech stocks connection a bully equilibrium of growth, profitability, and worth successful the existent environment. It's large to diversify portfolios with alternate exertion stocks. Although Meta is presently rated Quant Hold, I judge this banal volition autumn to a Sell standing fixed the marketplace situation and headwinds Zuckerberg faces. Many Communications Stocks are successful acold amended signifier than Meta. Seeking Alpha offers a database of Top Technology Stocks with beardown growth, charismatic valuations, coagulated profitability, and affirmative upward analysts' net revisions. Consider immoderate of the alternatives for your portfolio.

This nonfiction was written by

Head of Quantitative Strategies astatine Seeking Alpha. Data investigation and mentation person taken halfway signifier successful my career. For my purpose, the mentation of information is the process of making consciousness of statistic that person been collected, analyzed, and scored. This skill-set has served arsenic a coagulated instauration for maine to place trends and marque transparent predictions successful the people of wealth management. It has besides allowed maine to make user-friendly web-based tools that furnish individuals with the indicators and signals to instantly construe the spot oregon weakness of a company's value. Importantly, this expertise has helped maine physique Wall Street trading desks, motorboat planetary hedge funds, and conception a SaaS FinTech concern probe company. Prior to my relation astatine Seeking Alpha arsenic the Head of Quantitative Strategies, I founded a Hedge money and Asset Management institution (Cress Capital Management), I was the Head of International Business Development astatine Northern Trust, and the bulk of my vocation was astatine Morgan Stanley moving a proprietary trading desk.

Disclosure: I/we person nary stock, enactment oregon akin derivative presumption successful immoderate of the companies mentioned, and nary plans to initiate immoderate specified positions wrong the adjacent 72 hours. I wrote this nonfiction myself, and it expresses my ain opinions. I americium not receiving compensation for it. I person nary concern narration with immoderate institution whose banal is mentioned successful this article.

.png) 2 years ago

38

2 years ago

38

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)