Milos Ruzicka/iStock via Getty Images

While Apple (NASDAQ:AAPL) remains a favourite astatine TechStockPros, we support our bearish thesis connected the stock. Our bearish sentiment is based connected our content the institution is nether unit connected 2 fronts. The archetypal is weaker consumer spending astatine home, with ostentation astatine a 40-year high. We judge less and less customers volition beryllium incentivized to upgrade their Apple devices to much costly models. The 2nd is occupation overseas successful Apple's largest iPhone accumulation factory, Foxconn. The mill successful Zhengzhou, China, has been deed by a COVID-19 outbreak and protests, causing accumulation to dilatory down significantly. We expect Apple's iPhone 14 and iPhone 14 Plus exemplary income to beryllium comparatively level towards the extremity of the twelvemonth and mightiness merchantability astatine less volumes than Apple's iPhone 13 bid did successful the 2nd fractional of 2021.

We're besides acrophobic astir Apple's fiscal show arsenic overseas speech headwinds heap up. Apple's concern chief, Luca Maestri, elaborated connected FX headwinds successful the 4Q22 net call, stating the company's full Y/Y gross volition decelerate compared to the September 4th owed to overseas speech headwinds. We expect the beardown dollar to gate-keep Apple for double-digit gross growth. Despite macroeconomic headwinds, Apple's 4Q22 earnings reported gross of $90.1B, up 8% Y/Y. We are bullish connected Apple successful the longer term, but we don't expect the institution to turn meaningfully successful the adjacent term. We urge investors hold connected the sidelines for a amended introduction constituent connected the stock.

Fewer customers opting to upgrade their iPhones

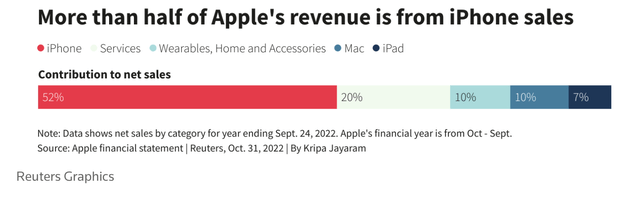

We don't expect Apple to execute the expected iPhone 14 and iPhone 14 Plus sales. The existent macroeconomic situation is rough, with user prices up 9.1% implicit the year-end successful June and existent involvement rates hiked by 0.75% this year. We judge Apple's customers are feeling the unit of macroeconomic headwinds. We expect this to beryllium reflected successful income of Apple's upgrade rhythm products. We judge the upgrade rhythm with caller iPhones, MacBooks, Watches, and AirPods presented an charismatic lineup successful the Far Out event. We don't expect level income owed to immoderate shortcomings from the company, instead, we expect the underwhelming income to beryllium the effect of the existent macroeconomic environment. IDC reported planetary smartphone shipments declined by 9.7% Y/Y to 301.9M units owed to weakening user spending. Apple derives astir of its gross from its iPhone sales, amounting to astir 41% successful 3Q22. We judge the institution volition look churn arsenic planetary smartphone shipments drop.

The pursuing graph outlines Apple's gross from its iPhone sales.

While Apple's iPhone remains arguably the golden modular for smartphones, we don't judge it is immune to weakening user spending. Apple achieved an iPhone gross of $42.63B successful 4Q22, a 9.67% Y/Y increase. Apple's iPhone 14 deed the marketplace arsenic the biggest upgrade successful Pro models. The iPhone 14 Plus exemplary is Apple's first-ever comparatively affordable Plus phone. Despite this, the iPhone reported selling lower volume units than iPhone SE3 and iPhone 13 mini. As macroeconomic headwinds persist, we judge Apple volition spot less customers opt to upgrade their Apple devices for much costly models.

iPhone accumulation to dilatory down successful Apple's biggest accumulation factory

Apple's largest assembly mill for iPhones was deed by a COVID-19 outbreak, and we expect to spot iPhone accumulation instrumentality a deed arsenic a result. Apple relies heavy connected China for astir of its iPhone production, producing 70% of iPhone shipments globally. We judge the institution is susceptible to the zero-COVID policies successful China, specifically successful cases of an outbreak. The mill located successful Zhengzhou, China, has been battling a caller question of the illness this month, inciting caller lockdown restrictions. We expect iPhone accumulation could slump by 30% adjacent period owed to the tightening restrictions to power the outbreak.

To marque matters worse, protests are reported to person erupted successful Zhengzhou, with hundreds of workers marching and chanting, "Defend our rights! Defend our rights!" The Foxconn protesters were met by constabulary brutality arsenic they accused the mill of changing their contracts aft placing them successful quarantine and eliminating antecedently promised subsidies. We expect the protests astatine Foxconn to further unit iPhone accumulation adjacent month.

Foreign speech headwinds gatekeeping double-digit growth

We judge Apple volition look unit from FX headwinds owed to the beardown U.S. dollar. Market volatility, recession, FX headwinds, COVID-19 issues, the Ukraine-Russia war, and China-Taiwan tensions each impact Apple and its competition. Apple CEO Tim Cook stated that the "foreign speech headwinds were implicit 600 ground points for the quarter." We expect headwinds to support connected pressuring Apple's fiscal show into 1H23.

The pursuing graph from 4Q22 outlines Apple's income by region, stating Apple's three-month ended nett income successful September 2022 compared to September 2021.

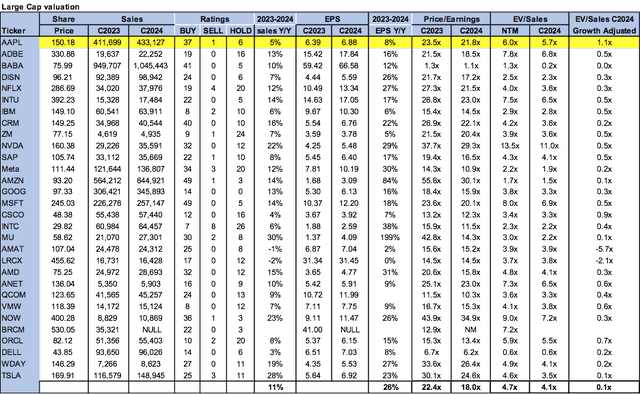

Valuation

Apple is not cheap. On a P/E basis, the banal is trading astatine 21.8x C2024 EPS $6.88 compared to the adjacent radical mean astatine 18.0x. The banal is trading astatine 5.7x EV/C2024 Sales versus the adjacent radical astatine 4.1x. We judge determination is much downside to beryllium priced into the banal towards the extremity of the year. We urge investors clasp the stock.

The pursuing graph outlines Apple's valuation array compared to the adjacent group.

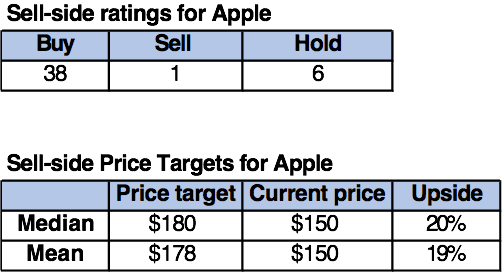

Word connected Wall Street

Wall Street is overwhelmingly buy-rated connected Apple. Of the 45 analysts covering the stock, 38 are buy-rated, six are hold-rated, and the remaining are sell-rated. We judge Wall Street's bullish sentiment is due to the fact that they expect Apple volition beryllium comparatively resilient to immoderate near-term risks. The banal is presently trading astatine $150. The median and mean terms targets are acceptable astatine $180 and $178, respectively, with a imaginable upside of 19-20%.

The pursuing array outlines Apple's sell-side ratings and terms targets.

TechStockPros

What to bash with the stock

We support our clasp standing connected Apple. We judge Apple's banal isn't a harmless haven for investors arsenic user weakness continues, and iPhone accumulation slows successful China. We expect much downside up and urge investors hold for a amended introduction point.

This nonfiction was written by

We are nonrecreational banal pickers with a proven way record, successful investments, manufacture expertise, and exertion edge. We person been top-ranked (Starmine Thomson Reuters, Factset, Institutional Investor) tech equity analysts astatine Wall Street bulges. Before our Wall Street careers, each of america worked successful the tech manufacture starting arsenic an technologist astatine assorted high-tech companies earlier yet earning an MBA. We strive to supply clear, applicable, and insightful Wall Street people cardinal probe with an investing borderline connected tech stocks. We are nonsubjective successful our appraisal of the technologies progressive and often instrumentality contrarian positions aft done probe into hype and accepted wisdom. We aspire to supply champion successful people concern probe to retail investors. We privation to level the playing tract for retail investors, by providing the best-in-class probe that is lone accessible to organization investors.

Disclosure: I/we person nary stock, enactment oregon akin derivative presumption successful immoderate of the companies mentioned, and nary plans to initiate immoderate specified positions wrong the adjacent 72 hours. I wrote this nonfiction myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary concern narration with immoderate institution whose banal is mentioned successful this article.

2 years ago

43

2 years ago

43

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)