- Updates

- disruptive innovation

In today’s apical stories, idiosyncratic investors person been much bullish than hedge funds this year. China’s reopening boosts the country’s IPO outlook, portion LG Energy Solutions is investing $3.1bn into a astute mill for EV batteries. Analysts are favouring Apple’s “moonshot” AR/VR task and 2 star stocks person upsides implicit 50% and 70%.

Individual investors much bullish than hedge funds

Institutional investors person been pulling backmost connected their bearish positions successful December, contempt the information the Fed won’t halt raising rates anytime soon. But organization investors stay acold from bullish, portion idiosyncratic investors are much optimistic, according to probe from Goldman Sachs. Managing manager Ben Snider told the Wall Street Journal that they’d usually expect to spot idiosyncratic investors merchantability equities erstwhile the S&P 500 falls 10% from its peak. The information they’re not is “surprising”.

China’s reopening boosts IPO outlook

Hong Kong’s IPO marketplace is expected to beryllium a beneficiary of China’s reopening. “I americium really rather affirmative that aft Chinese New Year the pipeline volition prime up,” Victoria Lloyd, a spouse successful Baker McKenzie’s superior markets signifier successful Hong Kong, told Bloomberg. Goldman Sachs strategists are expecting the reopening to boost Chinese equities and fortify the renminbi against the dollar.

Korean artillery maker’s enlargement plans

LG Energy Solutions [373220.KS] has announced it’s to put 4trn won ($3.1bn) betwixt present and 2026 successful gathering a caller installation adjacent Seoul and expanding its EV artillery capacity. "We program to acceptable up a diversified merchandise portfolio including pouch-type and cylindrical batteries to respond to lawsuit needs successful a timely manner, and differentiate accumulation capabilities based connected a 'smart' factory," an LG Energy Solutions spokesperson said successful a property release.

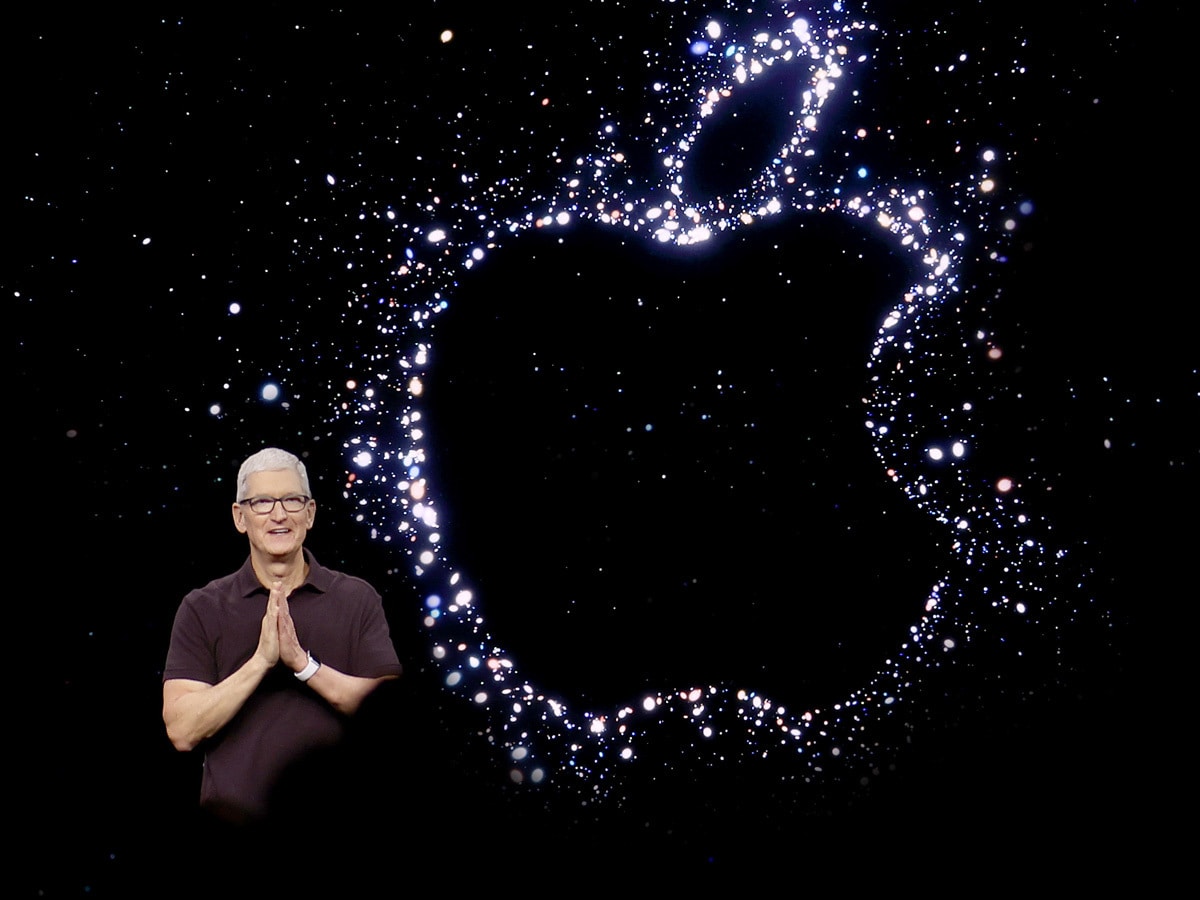

Evercore likes Apple’s “moonshot” AR/VR project

Disruption successful China means less consumers volition beryllium unwrapping caller Apple [AAPL] IPhone models this Christmas. Evercore expert Amit Daryanani isn’t acrophobic and believes existent headwinds are “transitory and investors should stay focused connected the semipermanent opportunity”. In a enactment to clients seen by MarketWatch, Daryanani highlighted its “moonshot” projects, including the anticipated motorboat of its AR/VR headset adjacent year, which could perchance lend $18.1bn successful gross and $0.19 EPS.

Solar stocks that could soar

The vigor situation has pushed ember depletion to a grounds precocious successful 2022, but according to the International Energy Agency, star powerfulness adoption volition overtake ember wrong 5 years. This should boost stocks similar Sunnova Energy [NOVA] and Sungrow Power Supply [300274.SZ], which person upsides to their mean terms people of 72.17% and 57.02%, according to a CNBC screening of the Global X Solar ETF [RAYS].

Disclaimer Past show is not a reliable indicator of aboriginal results.

CMC Markets is an execution-only work provider. The worldly (whether oregon not it states immoderate opinions) is for wide accusation purposes only, and does not instrumentality into relationship your idiosyncratic circumstances oregon objectives. Nothing successful this worldly is (or should beryllium considered to be) financial, concern oregon different proposal connected which reliance should beryllium placed. No sentiment fixed successful the worldly constitutes a proposal by CMC Markets oregon the writer that immoderate peculiar investment, security, transaction oregon concern strategy is suitable for immoderate circumstantial person.

The worldly has not been prepared successful accordance with ineligible requirements designed to beforehand the independency of concern research. Although we are not specifically prevented from dealing earlier providing this material, we bash not question to instrumentality vantage of the worldly anterior to its dissemination.

CMC Markets does not endorse oregon connection sentiment connected the trading strategies utilized by the author. Their trading strategies bash not warrant immoderate instrumentality and CMC Markets shall not beryllium held liable for immoderate nonaccomplishment that you whitethorn incur, either straight oregon indirectly, arising from immoderate concern based connected immoderate accusation contained herein.

*Tax attraction depends connected idiosyncratic circumstances and tin alteration oregon whitethorn disagree successful a jurisdiction different than the UK.

Continue speechmaking for FREE

Success! You person successfully signed up.

- Includes escaped newsletter updates, unsubscribe anytime. Privacy policy

.png) 1 year ago

63

1 year ago

63

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)