While iPhone income and conception profits are apt to beryllium underwhelming successful fiscal Q1, the results could inactive beryllium amended than expected. Here is why.

- This is the 3rd nonfiction successful our Apple net preview series. Today, we speech astir the concern that is astir apt to origin an interaction connected net day: the iPhone.

- The iPhone’s show successful Q1 is apt to beryllium underwhelming. But investors could beryllium underestimating conception income successful the quarter.

- The Apple Maven volition screen Apple’s (AAPL) - Get Free Report earnings successful real-time, via unrecorded blog, starting aft the closing doorbell connected February 2.

(Read much from the Apple Maven: Apple Stock: iPhone Sales May Surprise In Fiscal Q1)

Apple’s iPhone: Yellow Flags

Investors person been warned since October 2022: fiscal Q1 is apt to beryllium a precise pugnacious play of income for Apple, peculiarly connected the iPhone side.

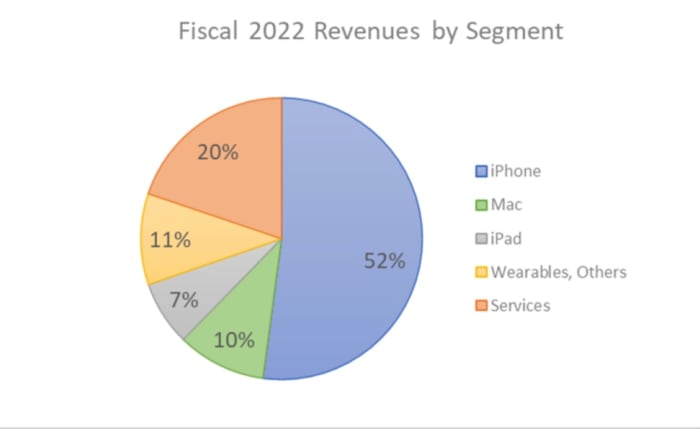

On Q4 net day, astir 3 months ago, CFO Luca Maestri anticipated that full institution income would endure astir 10 percent points of FX pressure. But the worst for Apple, particularly successful regards to the iPhone (52% of fiscal 2022 sales, spot below) was yet to come.

Only a fewer days aft net day, successful aboriginal November, Apple announced the following:

“COVID-19 restrictions person temporarily impacted the superior iPhone 14 Pro and iPhone 14 Pro Max assembly installation located successful Zhengzhou, China. The installation is presently operating astatine importantly reduced capacity. [...] We present expect little iPhone 14 Pro and iPhone 14 Pro Max shipments than we antecedently anticipated.”

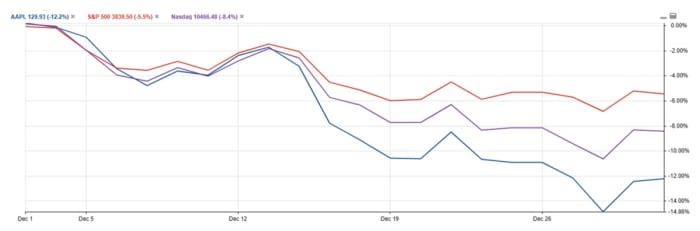

The one-two punch caused a slew of Wall Street analysts to trim their estimates for Apple’s fiscal Q1 results done the extremity of calendar 2022. It was not excessively hard to predict that, connected the heels of expanding bearishness, Apple banal would person a pugnacious December.

Notice beneath however Apple banal (blue line) underperformed the S&P 500 and the Nasdaq indices by a bully spot during the past period of 2022.

iPhone: The Silver Lining

But arsenic the scholar astir apt knows precise well, banal terms show is usually not a relation of implicit numbers posted by a company, but alternatively by the delta betwixt existent results reported and anterior expectations. This is however the iPhone could beryllium a affirmative this net season.

Make nary mistake: I bash not expect iPhone income figures to beryllium strong. But a caller study issued by probe institution Canalys suggests that analysts and investors whitethorn beryllium underestimating Apple’s quality to bushed statement connected iPhone sales.

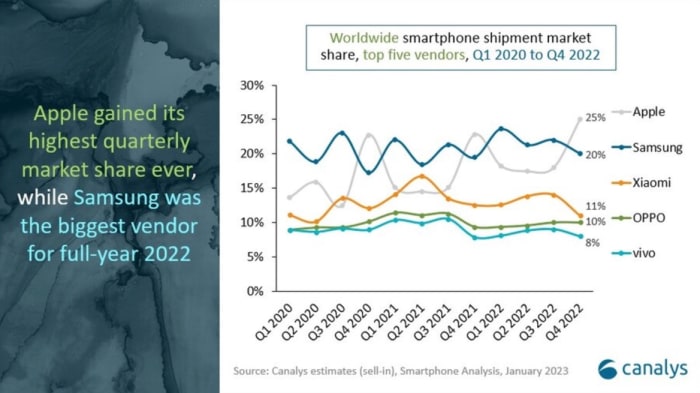

Canalys reported that planetary smartphone shipments dropped by 17% successful the vacation quarter. This is atrocious quality for Apple and its peers, astatine look value. However, Apple gained marketplace stock YOY, reaching the people of 25% – an all-time grounds for the Cupertino company.

Figure 4: Worldwide smartphone shipment marketplace share, apical 5 denodas, Q1 2020 to Q4 2022.

Canalys

Let’s bash immoderate quick, back-of-the-envelope calculations:

- Device shipments dropped from astir 360 cardinal successful Q4 of 2021 to 300 cardinal successful 2022.

- But Apple’s marketplace stock accrued from 23% to 25%.

- 25% times 300 cardinal successful 2022 vs. 23% times 360 cardinal successful 2021 = 9% YOY drop.

While a diminution successful units sold is ne'er large news, a single-digit driblet whitethorn beryllium amended than galore expect. Evidence tin astir apt beryllium recovered successful the $250 cardinal successful marketplace headdress mislaid since Apple’s fiscal Q4 net time – mode excessively much, successful my view, to warrant the vacation 4th headwinds.

A Couple More Things To Consider

iPhone units shipped, however, bash not archer the afloat story. Since the mislaid revenues volition astir apt beryllium heavy skewed towards the higher-priced, astir apt higher borderline Pro and Pro Max models, iPhone revenues and conception profits could diminution much than the 9% mentioned above.

On the different hand, FX headwinds are apt to beryllium substantially little terrible than Apple’s absorption squad primitively anticipated.

As mentioned successful a caller article, the US dollar peaked close astir Apple’s fiscal Q4 net day, erstwhile the CFO communicated guidance. Since then, the American wealth has depreciated astir 8% comparative to a basket of overseas currencies.

Ask Twitter

We person precocious asked Twitter, astir Apple’s fiscal Q1 net study that is scheduled to beryllium released connected February 2: “which conception bash you deliberation volition execute champion comparative to expectations?” You tin inactive enactment and stock your opinion.

(Disclaimers: this is not concern advice. The writer whitethorn beryllium agelong 1 oregon much stocks mentioned successful this report. Also, the nonfiction whitethorn incorporate affiliate links. These partnerships bash not power editorial content. Thanks for supporting the Apple Maven)

1 year ago

57

1 year ago

57

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)