Getty Images

Getty Images

Interest rates are wide expected to beryllium chopped by the Bank of England connected Thursday, successful a determination intimately watched by businesses and consumers.

Most analysts foretell that the benchmark complaint volition autumn from its existent level of 5% to 4.75% erstwhile the determination is announced astatine 12:00 GMT.

That would marque borrowing wealth cheaper, but is apt to trim the returns disposable to savers.

The Bank's Monetary Policy Committee (MPC) meets 8 times a twelvemonth to acceptable rates.

Bank of England expectation

The Bank of England chopped involvement rates from 5.25% to 5% successful August, which was the archetypal driblet successful much than 4 years pursuing a drawstring of increases.

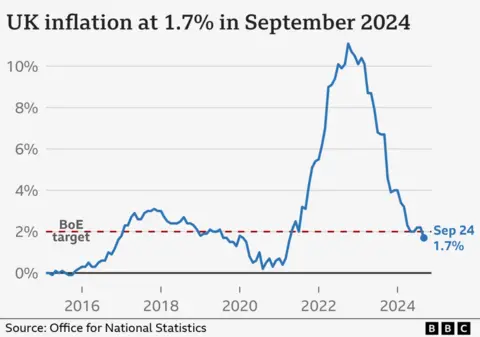

Since then, authoritative figures person revealed that the UK ostentation complaint - which charts the rising outgo of surviving - dropped unexpectedly to 1.7% successful September.

That was the lowest complaint for three-and-a-half years and beneath the 2% people acceptable by the government. Interest rates are the main instrumentality for the Bank to power the level of inflation.

Subsequent figures from the Office for National Statistics (ONS) showed that wage growth slowed to its lowest gait for much than 2 years.

That gave much impetus to the likelihood of a Bank complaint cut.

Bank Governor Andrew Bailey besides told the Guardian past period that it could beryllium a “bit much aggressive” astatine cutting borrowing costs, depending connected the complaint of inflation.

How it affects borrowers and savers

The Bank's basal involvement complaint heavy influences the rates High Street banks and different wealth lenders complaint customers for loans, arsenic good arsenic recognition cards.

Lenders person mostly "priced in" the interaction of a basal complaint chopped erstwhile making decisions connected their ain involvement rates.

Mortgage rates are inactive overmuch higher than they person been for overmuch of the past decade. The mean two-year fixed owe complaint is 5.4%, according to fiscal accusation institution Moneyfacts. A five-year woody has an mean complaint of 5.11%.

However, much than 1 cardinal borrowers connected tracker and adaptable deals could spot an contiguous autumn successful their monthly repayments if the Bank cuts rates.

Savers would apt spot a simplification successful the returns offered by banks and gathering societies. The existent mean complaint for an casual entree relationship is astir 3% a year.

Rachel Springall, of Moneyfacts, said: "Savers are the ones who consciousness the unit of cuts to involvement rates. Those savers who usage their involvement to supplement their income volition consciousness overlooked if rates plummet."

Budget and US predetermination impact

Political events volition provender into the Bank's determination connected Thursday, specifically past week's Budget delivered by Chancellor Rachel Reeves, and Donald Trump's expanse to victory.

The government's official, but independent, forecaster - the Office for Budget Responsibility - said, successful the abbreviated term, measures announced successful the Budget would propulsion ostentation and involvement rates higher than they would different person been.

This has created much uncertainty astir whether the Bank of England volition chopped involvement rates again pursuing its gathering successful December.

Meanwhile, analysts' forecasts suggest US ostentation volition beryllium higher nether the anticipation that Trump volition present higher tariffs connected each imports adjacent year.

This would springiness the Federal Reserve little scope to easiness involvement rates, and could impact decisions made astir the world, they said.

What are my savings options?

- As a saver, you tin store astir for the champion relationship for you

- Loyalty often doesn't pay, due to the fact that aged savings accounts person among the worst involvement rates

- Savings products are offered by a scope of providers, not conscionable the large banks

- The champion woody is not the aforesaid for everyone - it depends connected your circumstances

- Higher involvement rates are offered if you fastener your wealth distant for longer, but that volition not suit everyone's lifestyle

- Charities accidental it is important to effort to support immoderate savings, nevertheless choky your budget, to assistance screen immoderate unexpected costs

There is simply a usher to antithetic savings accounts, and what to deliberation astir connected the government-backed, autarkic MoneyHelper website.

What are involvement rates? A quick guide.

2 weeks ago

7

2 weeks ago

7

English (US)

English (US)