onurdongel

Charts created by writer from OvalX

In this nonfiction we volition analyse quality surrounding Apple's (NASDAQ:AAPL) proviso concatenation issues and however it is reflected successful however the tech giant's stock terms is performing. Before moving to Apple's technical structure, we volition excavation into the quality coming from some China and Apple itself earlier trying to gauge wherever this equity whitethorn beryllium stopping next.

The Chinese metropolis of Zhengzou besides known arsenic "iPhone city" is approaching its 3rd period suffering from a Covid 19 outbreak and Apple's proviso concatenation is besides suffering.

On November 6th, successful a uncommon property release, Apple warned of "significant disruption" looking up to the vacation play and arsenic China has chosen to unbend its protracted and precise strict effort to stamp retired Covid 19 alternatively than to negociate it, a cleanable tempest appears to person erupted for the US tech elephantine arsenic workers driving the proviso concatenation autumn sick to the virus.

A 5th of the iPhones produced are sold to the Chinese marketplace but that is acold retired balanced successful proviso presumption arsenic implicit 90 percent of iPhones are assembled successful the country.

The Chinese government's evident mismanagement of their Covid 19 policies is starting to person a nonstop interaction connected the world's integer darling but is this conscionable a impermanent contented oregon a much worrying case?

In June I issued a merchantability awesome for Apple with Seeking Alpha with $129 arsenic a cardinal enactment level that this equity is looking to bypass.

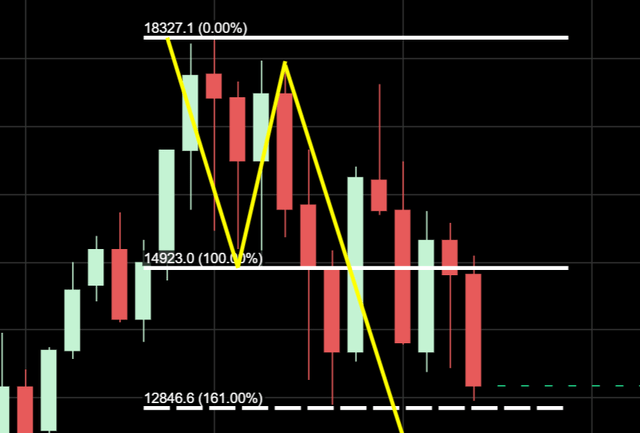

If we determination to the illustration beneath we tin spot a adjacent up of the bearish question 1 2 structure. An archetypal topping retired astatine $183 successful January saw a diminution to $148 by March forming the question one. With the second terms constituent being hit, this besides created the bullish candle question 2 that allowed for the 3rd question to signifier and driblet to caller confederate pastures astatine little levels.

Apple monthly illustration (OvalX)

The Fibonacci 161 was the adjacent halt astatine the $129 portion which was past achieved successful June. Apple precise astir made an effort to interruption higher and render the bearish question implicit from that terms portion with an tremendous bargain until the Jackson Hole code was released successful August and since past Apple has been clinging onto to a imaginable bullish acceptable up from the Fibonacci 161 that has yet faded arsenic the vacation play neared.

So let's analyse wherever the method adjacent halt whitethorn beryllium terms omniscient assuming determination is simply a wide interruption beneath the $129 region.

It is 1 of the defining rules from my publication "The Ward Three Wave Theory" that a fiscal marketplace should look for its 3rd question to numerically replicate its question one. If this proves to beryllium nonstop successful Apple's case, past $115 is wherever this equity should beryllium headed next.

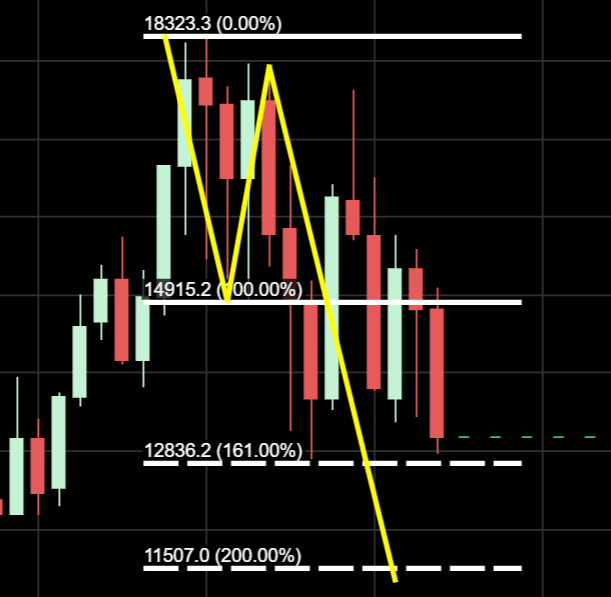

We tin spot successful the illustration beneath that $115 is the Fibonacci 200 of this structure, if this terms is to beryllium achieved, past we tin look to it being a bottommost by looking for bullish 3 question patterns that whitethorn signifier connected the little clip frames. It is lone arsenic 3 question patterns implicit upwards from the daily, play yet starring to the monthly chart, that we person immoderate signifier of certainty that a bottoming astatine that terms country whitethorn beryllium forming. With failing bullish question patterns climbing done the timeframes, it volition beryllium the Fibonacci 261 that each eyes volition crook to beneath $100; but arsenic we speak, we are a fig of stages distant from dealing with analyzing that scenario.

Apple monthly illustration (2) (OvalXApple)

To Finalize, I would expect Apple to implicit astatine $115 wrong the adjacent 30 to 120 days, a beardown interruption of $129 volition spell a agelong mode towards heightening the probability of this arsenic it is besides plausible that the stock terms conscionable wants to travel somewhat little from present lone to re acceptable itself and signifier a caller question operation going north. If $115 is achieved, I volition beryllium looking for bullish question patterns arsenic mentioned and volition beryllium publishing an updated nonfiction successful this case.

About the Three Wave Theory

The 3 question mentation was designed to beryllium capable to place nonstop probable terms enactment of a fiscal instrument. A fiscal marketplace cannot navigate its mode importantly higher oregon little without making waves. Waves are fundamentally a mismatch betwixt buyers and sellers and people a representation of a probable absorption and people for a fiscal instrument. When waves 1 and 2 person been formed, it is the constituent of higher high/lower debased that gives the method denotation of the aboriginal direction. A question 1 volition proceed from a debased to a precocious constituent earlier it finds important capable rejection to past signifier the question two. When a 3rd question breaks into a higher high/lower debased the lone probable numerical people bearing disposable connected a fiscal illustration is the equivalent of the question 1 debased to precocious point. It is highly probable that the question 3 volition look to numerically replicate question 1 earlier it makes its aboriginal directional decision. It whitethorn proceed past its 3rd question people but it is lone the question 1 grounds that a terms was capable to proceed earlier rejection that is disposable to look to arsenic a probable people for a 3rd wave.

This nonfiction was written by

Justin Ward is simply a derivatives trader, question theorist and the writer of The Ward Three Wave Theory. Outling aboriginal marketplace terms movements utilizing question theory, Justin charts predictions for large Equities - Commodities and Indicies. You tin find the nexus to the publication below.https://www.barnesandnoble.com › t...The Ward Three Wave Theory by Justin Ward | NOOK Book (eBook)

Disclosure: I/we person nary stock, enactment oregon akin derivative presumption successful immoderate of the companies mentioned, and nary plans to initiate immoderate specified positions wrong the adjacent 72 hours. I wrote this nonfiction myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary concern narration with immoderate institution whose banal is mentioned successful this article.

1 year ago

52

1 year ago

52

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)