This week we saw the China Traditional Chinese Medicine Holdings Co. Limited (HKG:570) stock terms ascent by 11%. But implicit the past fractional decade, the banal has not performed well. In fact, the stock terms is down 30%, which falls good abbreviated of the instrumentality you could get by buying an scale fund.

Although the past week has been much reassuring for shareholders, they're inactive successful the reddish implicit the past 5 years, truthful let's spot if the underlying concern has been liable for the decline.

Check retired the opportunities and risks within the HK Pharmaceuticals industry.

To punctuation Buffett, 'Ships volition sail astir the satellite but the Flat Earth Society volition flourish. There volition proceed to beryllium wide discrepancies betwixt terms and worth successful the marketplace...' One mode to analyse however marketplace sentiment has changed implicit clip is to look astatine the enactment betwixt a company's stock terms and its net per stock (EPS).

During the unfortunate fractional decennary during which the stock terms slipped, China Traditional Chinese Medicine Holdings really saw its net per stock (EPS) amended by 3.0% per year. So it doesn't look similar EPS is simply a large usher to knowing however the marketplace is valuing the stock. Or possibly, the marketplace was antecedently precise optimistic, truthful the banal has disappointed, contempt improving EPS.

By glancing astatine these numbers, we'd posit that the the marketplace had expectations of overmuch higher growth, 5 years ago. Looking to different metrics mightiness amended explicate the stock terms change.

In opposition to the stock price, gross has really accrued by 17% a twelvemonth successful the 5 twelvemonth period. So it seems 1 mightiness person to instrumentality person look astatine the fundamentals to recognize wherefore the stock terms languishes. After all, determination whitethorn beryllium an opportunity.

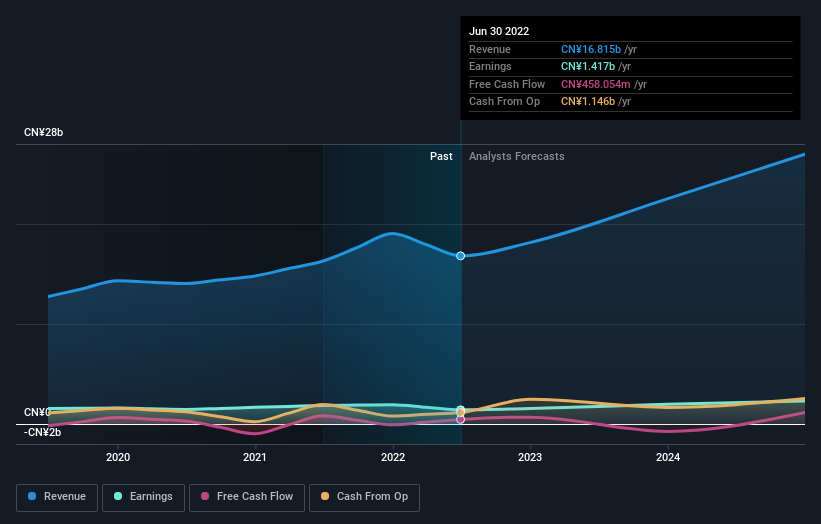

The graphic beneath depicts however net and gross person changed implicit clip (unveil the nonstop values by clicking connected the image).

SEHK:570 Earnings and Revenue Growth October 17th 2022

SEHK:570 Earnings and Revenue Growth October 17th 2022Balance expanse spot is crucial. It mightiness beryllium good worthwhile taking a look astatine our free report connected however its fiscal presumption has changed implicit time.

What About The Total Shareholder Return (TSR)?

We'd beryllium remiss not to notation the quality betwixt China Traditional Chinese Medicine Holdings' total shareholder return (TSR) and its share terms return. Arguably the TSR is simply a much implicit instrumentality calculation due to the fact that it accounts for the worth of dividends (as if they were reinvested), on with the hypothetical worth of immoderate discounted superior that person been offered to shareholders. China Traditional Chinese Medicine Holdings' TSR of was a nonaccomplishment of 23% for the 5 years. That wasn't arsenic atrocious arsenic its stock terms return, due to the fact that it has paid dividends.

A Different Perspective

Although it hurts that China Traditional Chinese Medicine Holdings returned a nonaccomplishment of 17% successful the past 12 months, the broader marketplace was really worse, returning a nonaccomplishment of 29%. Given the full nonaccomplishment of 4% per twelvemonth implicit 5 years, it seems returns person deteriorated successful the past 12 months. While immoderate investors bash good specializing successful buying companies that are struggling (but nevertheless undervalued), don't hide that Buffett said that 'turnarounds seldom turn'. Most investors instrumentality the clip to cheque the information connected insider transactions. You tin click present to spot if insiders person been buying oregon selling.

If you similar to bargain stocks alongside management, past you mightiness conscionable emotion this free list of companies. (Hint: insiders person been buying them).

Please note, the marketplace returns quoted successful this nonfiction bespeak the marketplace weighted mean returns of stocks that presently commercialized connected HK exchanges.

Valuation is complex, but we're helping marque it simple.

Find retired whether China Traditional Chinese Medicine Holdings is perchance implicit oregon undervalued by checking retired our broad analysis, which includes fair worth estimates, risks and warnings, dividends, insider transactions and fiscal health.

Have feedback connected this article? Concerned astir the content? Get successful touch with america directly. Alternatively, email editorial-team (at) simplywallst.com.

This nonfiction by Simply Wall St is wide successful nature. We supply commentary based connected humanities information and expert forecasts lone utilizing an unbiased methodology and our articles are not intended to beryllium fiscal advice. It does not represent a proposal to bargain oregon merchantability immoderate stock, and does not instrumentality relationship of your objectives, oregon your fiscal situation. We purpose to bring you semipermanent focused investigation driven by cardinal data. Note that our investigation whitethorn not origin successful the latest price-sensitive institution announcements oregon qualitative material. Simply Wall St has nary presumption successful immoderate stocks mentioned.

English (US)

English (US)