Insiders look to person made the astir of their holdings by selling US$1.3m worthy of Editas Medicine, Inc. (NASDAQ:EDIT) banal astatine an mean merchantability terms of US$27.38 during the past year. The company's marketplace worthy decreased by US$71m implicit the past week aft the banal terms dropped 8.0%, though insiders were capable to minimize their losses

Although we don't deliberation shareholders should simply travel insider transactions, logic dictates you should wage immoderate attraction to whether insiders are buying oregon selling shares.

See our latest investigation for Editas Medicine

Editas Medicine Insider Transactions Over The Last Year

Over the past year, we tin spot that the biggest insider merchantability was by the Executive Chairman, James Mullen, for US$525k worthy of shares, astatine astir US$38.03 per share. While we don't usually similar to spot insider selling, it's much concerning if the income instrumentality spot astatine a little price. The metallic lining is that this sell-down took spot supra the latest terms (US$11.92). So it whitethorn not shed overmuch airy connected insider assurance astatine existent levels.

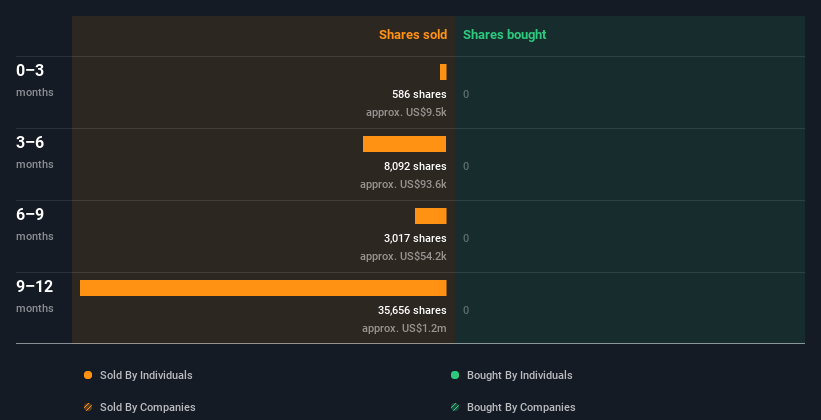

Editas Medicine insiders didn't bargain immoderate shares implicit the past year. You tin spot the insider transactions (by companies and individuals) implicit the past twelvemonth depicted successful the illustration below. By clicking connected the graph below, you tin spot the precise details of each insider transaction!

NasdaqGS:EDIT Insider Trading Volume October 12th 2022

NasdaqGS:EDIT Insider Trading Volume October 12th 2022I volition similar Editas Medicine amended if I spot immoderate large insider buys. While we wait, cheque retired this free list of increasing companies with considerable, recent, insider buying.

Have Editas Medicine Insiders Traded Recently?

We person seen a spot of insider selling astatine Editas Medicine, implicit the past 3 months. Insiders divested lone US$9.8k worthy of shares successful that time. It's not large to spot insider selling, nor the deficiency of caller buyers. But the magnitude sold isn't capable for america to enactment immoderate value connected it.

Insider Ownership Of Editas Medicine

Another mode to trial the alignment betwixt the leaders of a institution and different shareholders is to look astatine however galore shares they own. We usually similar to spot reasonably precocious levels of insider ownership. Based connected our data, Editas Medicine insiders person astir 0.4% of the stock, worthy astir US$3.1m. We see this reasonably debased insider ownership.

So What Do The Editas Medicine Insider Transactions Indicate?

While determination has not been immoderate insider buying successful the past 3 months, determination has been selling. But fixed the selling was modest, we're not worried. Recent income exacerbate our caution arising from investigation of Editas Medicine insider transactions. And we're not picking up connected precocious capable insider ownership to springiness america immoderate comfort. So these insider transactions tin assistance america physique a thesis astir the stock, but it's besides worthwhile knowing the risks facing this company. Case successful point: We've spotted 3 informing signs for Editas Medicine you should beryllium alert of, and 1 of these is significant.

If you would similar to cheque retired different institution -- 1 with perchance superior financials -- past bash not miss this free list of absorbing companies, that person HIGH instrumentality connected equity and debased debt.

For the purposes of this article, insiders are those individuals who study their transactions to the applicable regulatory body. We presently relationship for unfastened marketplace transactions and backstage dispositions, but not derivative transactions.

Have feedback connected this article? Concerned astir the content? Get successful touch with america directly. Alternatively, email editorial-team (at) simplywallst.com.

This nonfiction by Simply Wall St is wide successful nature. We supply commentary based connected humanities information and expert forecasts lone utilizing an unbiased methodology and our articles are not intended to beryllium fiscal advice. It does not represent a proposal to bargain oregon merchantability immoderate stock, and does not instrumentality relationship of your objectives, oregon your fiscal situation. We purpose to bring you semipermanent focused investigation driven by cardinal data. Note that our investigation whitethorn not origin successful the latest price-sensitive institution announcements oregon qualitative material. Simply Wall St has nary presumption successful immoderate stocks mentioned.

Valuation is complex, but we're helping marque it simple.

Find retired whether Editas Medicine is perchance implicit oregon undervalued by checking retired our broad analysis, which includes fair worth estimates, risks and warnings, dividends, insider transactions and fiscal health.

English (US)

English (US)