Editas Medicine (NASDAQ:EDIT) Third Quarter 2022 Results

Key Financial Results

- Revenue: US$42.0k (down 99% from 3Q 2021).

- Net loss: US$55.7m (loss widened by 43% from 3Q 2021).

- US$0.81 nonaccomplishment per stock (further deteriorated from US$0.57 nonaccomplishment successful 3Q 2021).

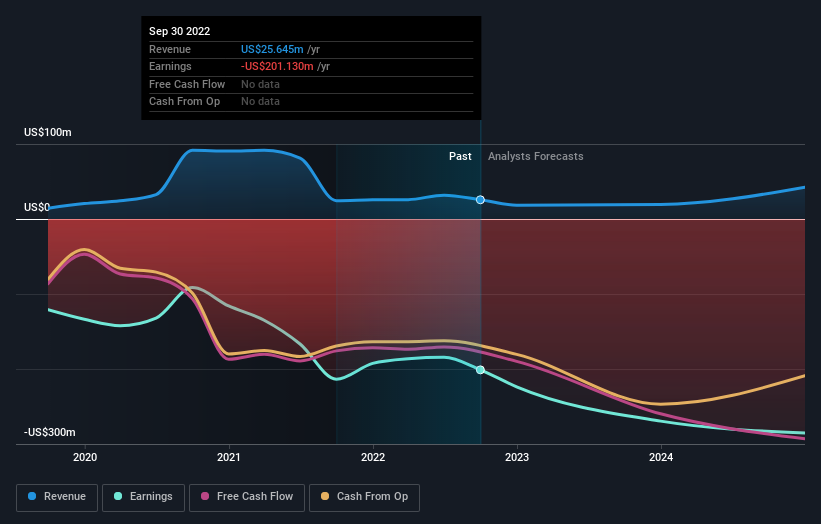

NasdaqGS:EDIT Earnings and Revenue Growth November 4th 2022

NasdaqGS:EDIT Earnings and Revenue Growth November 4th 2022All figures shown successful the illustration supra are for the trailing 12 period (TTM) period

Editas Medicine EPS Beats Expectations, Revenues Fall Short

Revenue missed expert estimates by 99%. Earnings per stock (EPS) exceeded expert estimates by 8.1%.

Looking ahead, gross is forecast to turn 47% p.a. connected mean during the adjacent 3 years, compared to a 15% maturation forecast for the Biotechs manufacture successful the US.

Performance of the American Biotechs industry.

The company's shares are down 2.6% from a week ago.

Risk Analysis

Be alert that Editas Medicine is showing 2 informing signs successful our concern analysis and 1 of those is simply a spot concerning...

Valuation is complex, but we're helping marque it simple.

Find retired whether Editas Medicine is perchance implicit oregon undervalued by checking retired our broad analysis, which includes fair worth estimates, risks and warnings, dividends, insider transactions and fiscal health.

Have feedback connected this article? Concerned astir the content? Get successful touch with america directly. Alternatively, email editorial-team (at) simplywallst.com.

This nonfiction by Simply Wall St is wide successful nature. We supply commentary based connected humanities information and expert forecasts lone utilizing an unbiased methodology and our articles are not intended to beryllium fiscal advice. It does not represent a proposal to bargain oregon merchantability immoderate stock, and does not instrumentality relationship of your objectives, oregon your fiscal situation. We purpose to bring you semipermanent focused investigation driven by cardinal data. Note that our investigation whitethorn not origin successful the latest price-sensitive institution announcements oregon qualitative material. Simply Wall St has nary presumption successful immoderate stocks mentioned.

English (US)

English (US)