Most integer and in-person relationship openings travel the aforesaid basal steps: The slope oregon recognition national collects the applicant’s data, verifies his oregon her identity, approves the application, collects a signature and allows the caller lawsuit to money the account.

The quality betwixt afloat integer relationship opening and what has been done by banks successful the past is not conscionable handling each the steps digitally, but wholly reimagining the process for a integer world. This includes, but is not constricted to, idiosyncratic acquisition driven responsive design, the request for simplified staging, and mobile recognition verification.

Done well, integer relationship opening eliminates a monolithic magnitude of keystrokes by pre-filling parts of the process from insights already disposable done superior oregon secondary sources. Most importantly, a integer relationship opening process should beryllium susceptible of completion wholly connected a mobile instrumentality successful little than 5 minutes.

Using mobile devices for relationship opening calls for the summation of new, mobile circumstantial features specified arsenic information seizure and papers upload via the instrumentality camera, interaction signatures, and determination tracking for reporting and perchance different functions, similar fraud prevention.

Digital relationship opening, astatine the basal level, would person the quality to execute the following:

- Capture and/or auto-fill basal idiosyncratic individuality information.

- Qualify applicants from a risk/fraud perspective.

- Verify applicant individuality (usually done third-party information sources).

- Fund digitally successful real-time (usually with either a debit/credit paper oregon with mobile deposit capture).

- Integrate with the halfway banking system.

Beyond the 5 halfway features, respective further features should beryllium included successful immoderate best-of-class integer relationship opening process:

- Contextual pre-qualification for, and cross-sell of, further products and services utilizing collected interior and outer insight.

- Online and mobile banking azygous sign-on (bypassing information introduction and individuality verification steps).

- Ability to prevention and resume integer relationship opening astatine immoderate constituent successful the process (supporting multichannel integration).

- Electronic signatures (replacing signature cards).

- Ability to upload photos of supporting recognition documents for integer retention (business agreements, etc.).

As we look astatine the aboriginal of integer relationship opening, the gathering of a mobile relationship opening process astatine velocity and standard should thrust the processes required for online relationship opening and adjacent subdivision openings.

Read More: Digital Account Opening: Hot Trend, But Kinks Hinder Speed

Digital Account Opening Trends

Most apical banks and recognition unions connection online relationship opening, yet mobile-optimized relationship opening capabilities, wherever a subdivision engagement is not required and wherever an relationship tin beryllium opened seamlessly wrong three-to-five minutes, is inactive not commonplace.

As mobile banking functionality and lawsuit acceptance of mobile banking has continued to increase, not being capable to unfastened a caller relationship rapidly and easy connected a mobile instrumentality has had a melodramatic antagonistic interaction connected relationship opening success.

Digital relationship openings (DAO) are done by some incumbent banks (some of which person digital-only components), integer challenger banks, and large tech firms who are progressively entering the banking battlefield. Traditional banks are progressively being held to the standards that neobanks and large tech firms person set. These firms person eliminated friction from the process and simplified onboarding utilizing integer channels.

The streamlining of processes has yielded important results. According to a 2020 survey from Lightico, lone 8% of consumers who usage digital-only banks said they had occupation opening a caller relationship online, outperforming large incumbents, specified arsenic Bank of America, wherever 30% reported difficulties. While section banks (16%) and recognition unions (21%) performed better, overmuch of this was attributed to greater quality involvement.

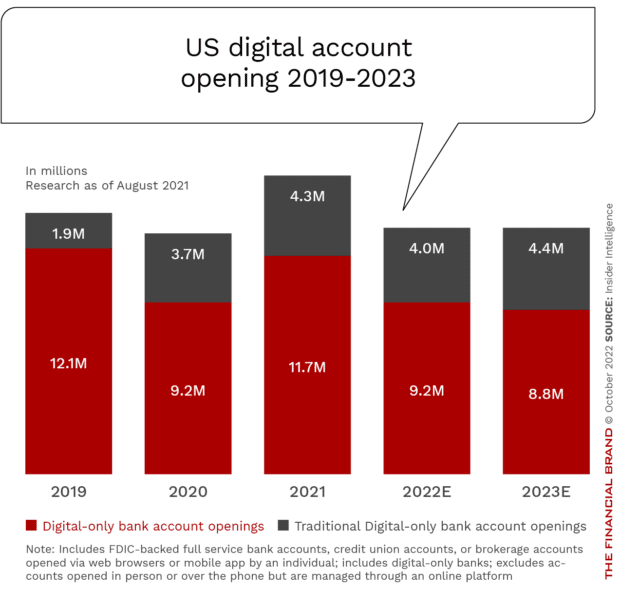

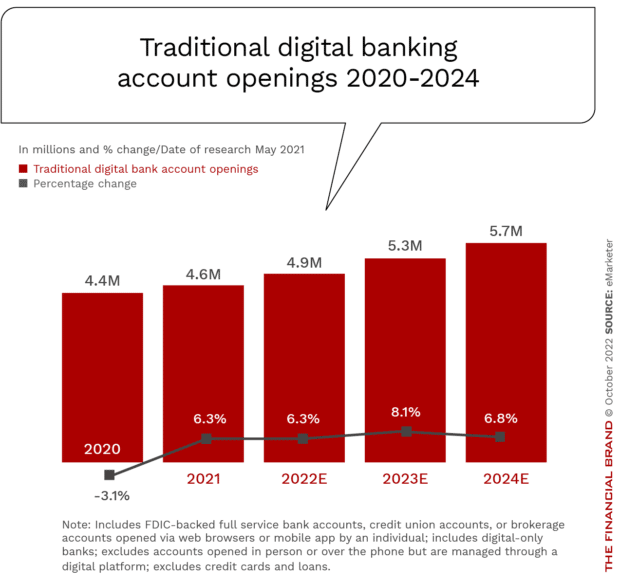

According to eMarketer, digital relationship openings fell drastically successful 2020 owed to the pandemic but person recovered to much incremental maturation successful 2022 and beyond. The biggest driblet during the pandemic was seen by digital-only players (primarily fintech firms) that saw relationship openings drop. Traditional fiscal institutions present indispensable respond to the request for seamless integer relationship opening oregon look important abandonment of caller relationship openings to much businesslike players.

Total digital-only slope relationship opens plummeted 48.2% twelvemonth implicit twelvemonth (YoY) successful 2020 but person since recovered. Traditional banks, connected the different hand, took overmuch little of a integer relationship opening deed successful 2020 (a 3.1% YoY shrinkage). They person since experienced a humble rebound that is expected to proceed successful the future.

Applying for an relationship with a neobank often takes astir two-to-five minutes — a fraction of the clip of astir incumbents (over 10, and often 15 minutes). One measurement that eliminates lawsuit vexation is that galore integer challengers rapidly divert integer applicants to a telephone halfway erstwhile a imaginable experiences challenges oregon abandons the integer relationship opening process.

According to eMarketer, “Granting customers entree to their accounts arsenic soon arsenic their applications person been approved, and cutting the jargon from their aesthetically designed communications, are immoderate of the different ways that integer challengers are disrupting the incumbent players.”

The vantage of accepted banking organizations is the operation of marque recognition, trust, breadth of relationship offerings, the availability of bequest relationship opening channels, and cross-selling opportunities. Alternatively, accepted banking organizations person the load of bequest halfway technology, higher costs to service customers owed to subdivision networks, greater regulatory scrutiny, and (in astir cases) the dependence connected third-party solution providers.

Read More: Back-Office Overhaul Critical to Digital Banking Transformation

REGISTER FOR THIS FREE WEBINAR

Before the Forum: Are You Ready to Take Digital to the Next Level?

Are you collecting the information you request successful bid to instrumentality the adjacent steps to instrumentality caller tools successful your integer strategy? We reply these questions and much successful this webinar.

WEDNESDAY, November 9th AT 2:00 PM (ET)

Enter your firm email address

Use of Third-Party Solution Providers

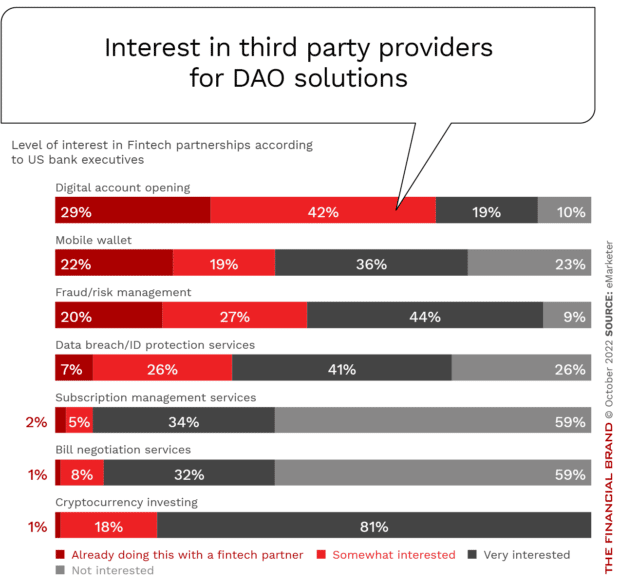

Traditional banking organizations tin either take to physique an interior solution, oregon they tin leverage third-party solution providers to supply immoderate oregon each of the components of the process. The usage of extracurricular solutions tin beryllium a large vantage owed to the velocity of implementation and scalability of solutions.

When Cornerstone Advisors asked astir the level of involvement successful utilizing third-party solution providers, 29% of organizations noted an involvement successful utilizing extracurricular partners to assistance successful gathering a amended integer relationship opening process.

New Account Abandonment Rates

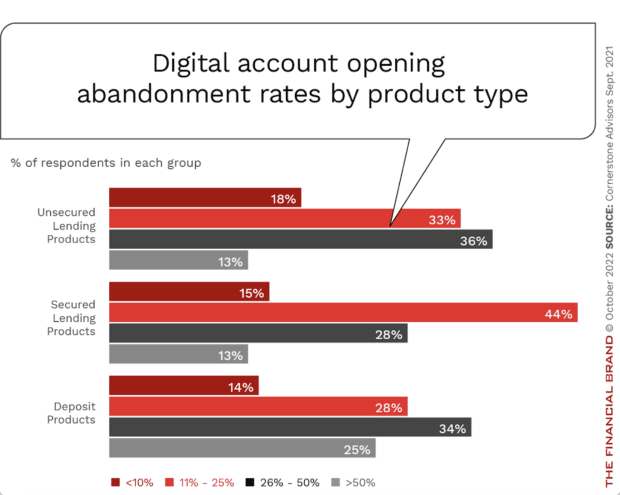

The biggest antagonistic interaction of a mediocre integer relationship opening process is the abandonment complaint of radical trying to unfastened a caller account. According to Q3 2020 information from Cornerstone, lone 14% of banks and recognition unions successful the U.S. said that their abandonment complaint for integer applications for deposit products was little than 10%. A 4th of the aforesaid firms said they were seeing rates higher than 50%.

The situation was adjacent much acute for larger fiscal institutions (those with much than $10 cardinal successful assets). Approximately a 3rd of larger institutions saw 75% oregon much of their integer deposit applications abandoned. Reasons for this level of abandonment included a lengthy exertion process, analyzable forms, the request to travel to a carnal installation for 1 oregon much steps of the process, and requests for excessively overmuch information.

Research by the Digital Banking Report recovered akin abandonment rates, particularly with organizations wherever integer relationship opening processes exceeded 10 minutes successful magnitude oregon wherever the user needed to supply penetration that was not readily available.

What Customers Want With Digital Account Opening

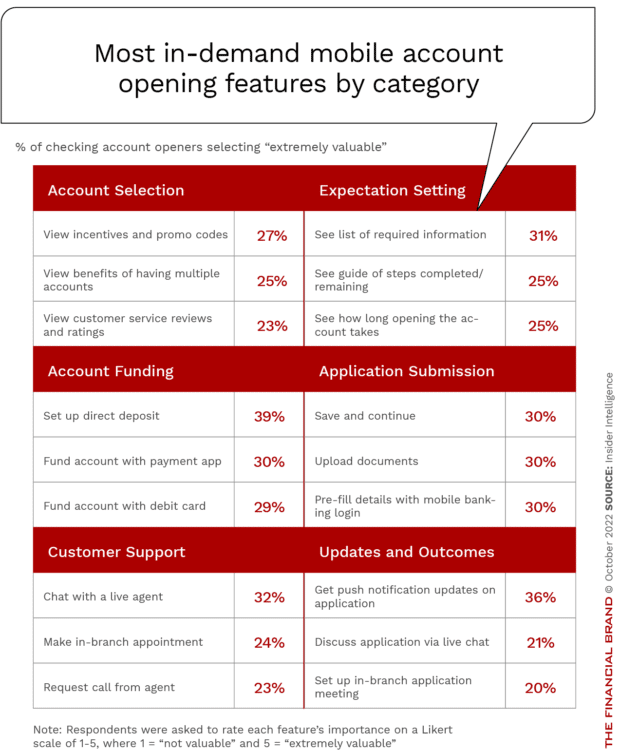

More consumers than ever are opening checking accounts online, raising the unit connected accepted fiscal institutions to make improved integer relationship opening experiences. Insider Intelligence utilized a scorecard of 35 emerging mobile slope account-opening features to find which ones consumers find astir valuable.

According to the research, the astir desired integer relationship opening features were:

- Ability to easy acceptable up nonstop deposit.

- Push notification updates connected advancement with the exertion process.

- The quality to chat with a unrecorded cause if needed.

- Providing a database of accusation needed astatine the opening of the process.

- Simplicity of integer relationship funding.

The biggest show spread betwixt what is desired and what is being delivered by bequest fiscal institutions was seen successful the areas of nonstop deposit setup and the quality to money the relationship with a integer outgo app. Meeting these integer relationship opening expectations is imperative since astir relationship openings volition apt beryllium via mobile successful the future. According to Insider Intelligence, 57% of U.S. adults who had opened a checking relationship successful the past 12 months did truthful connected mobile devices.

Crucial to Build connected Digital Account Opening Progress

Legacy fiscal institutions are focusing efforts connected improving the integer caller relationship opening process. While advancement has been made, determination is inactive overmuch to beryllium done, particularly successful updating back-office processes to alteration accelerated and seamless ‘top of glass’ experiences.

It is expected that the operation of decreased integer relationship openings by fintech firms and improved opening experiences by accepted banks and recognition unions volition effect successful much integer relationship openings being done astatine bequest banks than fintech firms wrong the adjacent 2 years. According to Insider Intelligence, it is besides expected that for some digital-only and incumbent providers, priorities volition displacement from “user maturation astatine each costs” to metrics that necktie backmost to the bottommost enactment – specified arsenic superior slope status, mean deposits, and imaginable for narration growth.

2 years ago

50

2 years ago

50

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)