Lemon_tm

Meta Platforms (NASDAQ:META) reported large-scale layoffs connected Wednesday Nov. 09 morning, affecting astir 10% of the company's astir 90 1000 employees. That's connected the backmost of the company's valuation dropping astir 75% successful conscionable implicit year, from a seemingly unassailable presumption arsenic precocious as September 2021.

Undeniably, portion economical concerns and Apple's privateness changes person affected the company, the fig 1 origin of that stock terms diminution is Meta Platform's absorption connected the metaverse. Mark Zuckerberg has admitted that himself.

Voting Shares and History

The occupation that Meta Platforms has is that Mark Zuckerberg's manus can't beryllium forced. He owns astir 55% of the voting rights contempt having 13% of the outstanding shares of the company. Despite a purported fiduciary work of CEOs, it's an incredibly precocious barroom to beryllium a CEO isn't operating successful shareholder's champion interests. In the meantime, Meta Platforms continues to spend.

The company's operating nonaccomplishment from the metaverse is expected to beryllium a monolithic ~$13 cardinal successful 2022. The institution has said it expects that to grow substantially successful 2023. For a institution with astir $40 cardinal successful yearly operating income that's enormous. The company's continued hiring of AR/VR employees highlights that the caller layoffs aren't focused connected stemming the circumstantial losses of the metaverse business.

The company's expenses are expected to grow substantially from ~$86 cardinal successful 2022 to $98-99 cardinal successful 2023. The company's guidance for Realty Labs operating losses to turn importantly twelvemonth implicit twelvemonth implies astir $20 cardinal successful apt operating losses for 2023. Due to Mark Zuckerberg's infatuation and voting stock ownership, shareholders can't halt it.

Metaverse Is A Fictitious Dream

The company's occupation is that the metaverse doesn't beryllium successful immoderate existent form. Even optimistic predictions astir Metaverse adoption, specified arsenic that the bulk of the colonisation volition beryllium utilizing it successful immoderate way, have 2030 arsenic the earliest date. It's worthy noting that for a fig of different crippled changing technologies, similar self-driving, adoption has consistently been slower than expected.

Our presumption has ever been that afloat self-driving wouldn't beryllium a crippled changer for immoderate company's financials until it wholly replaced the request to usage a steering wheel. So acold that has proven to beryllium correct. Our presumption is the aforesaid for the Metaverse where, until it becomes a place, technologically, that radical tin emulate existent life, it won't beryllium crippled changing.

So far, there's nary denotation of that happening. The company's operating nonaccomplishment continues to summation arsenic it works to make a technological marvel, but truthful far, the institution has fixed nary denotation of turning that to profits. The institution has announced that volition grow substantially into 2023.

While it's wide that the institution dominates successful this emerging market, with its Oculus headset, the institution is spending a important magnitude of wealth to turn the metaverse. So what's fictitious present too your legs successful the metaverse? A crippled plan, intelligibly laid out, to ever travel adjacent to achieving the imagination Mark Zuckerberg has.

Core Platform Results

Meta's fiscal show is based connected the continued spot of its halfway platform.

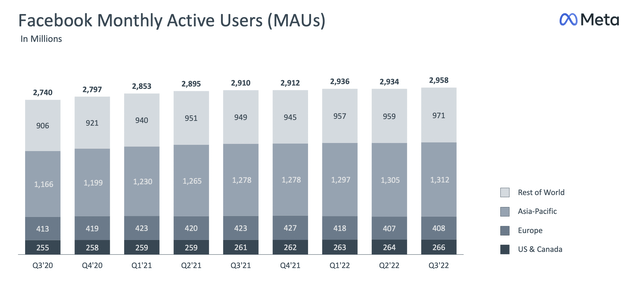

Meta Core Platform - Meta Investor Presentation

Facebook's monthly progressive users successful the astir caller 4th was astir 3 cardinal users, representing astir fractional of the world's position. As is wide from the supra chart, the company's properties are remaining beardown with dependable 5% YoY maturation for each of the past 2 years. Facebook itself remains the halfway level for users generating important idiosyncratic activity.

That maturation has been seen some successful incredibly profitable markets specified arsenic successful the US & Canada on with faster increasing markets specified arsenic Asia-Pacific and the Rest of World.

That continued maturation successful progressive users is seen crossed the company's platforms. Some similar Instagram are increasing overmuch faster. That continued spot on with tenable financials (discussed below) item however successful a mean situation the institution could thrust important shareholder returns.

Financials

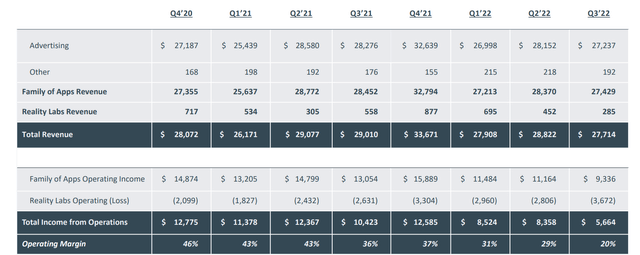

The company's financials proceed to stay strong, but it's wide of the interaction that the Metaverse is having connected the company.

Meta Platforms Investor Presentation

Meta Financials - Meta Investor Presentation

Meta Platforms made different mistake erstwhile it spent connected $10s of billions of buybacks astatine a overmuch higher terms per share, earlier it started losing monolithic amounts of money. The company's full gross successful the astir caller 4th were $27.7 cardinal a 5% YoY increase. However, looking astatine the 4th quarter, the company's 2022 gross volition apt beryllium much than 2020 but beneath 2021.

The company's world labs isn't changing its gross substantially, nor is different revenue, but what's remaining incredibly beardown for the institution is its advertizing gross performance. Unfortunately, what's hurting the institution is what's happening with that revenue. Costs are going up, dragging down operating income adjacent earlier expanding Reality Labs losses amusement up.

The institution is inactive profitable, that's clear. But its operating borderline has dropped from the mid-40s % to 20%. Current operating income inactive gives the institution a P/E of astir 15 indicating however profitable it is, however, the forecast is for profits to driblet further. We'd similar to spot the institution code down Reality Labs associated spending substantially, and absorption connected stock repurchases.

Our View

The reply present is clear.

Regardless of the semipermanent imaginable of Reality Labs, determination is simply a occupation erstwhile the CEO (Mark Zuckerberg) owns 55% of the voting shares with a overmuch smaller % of the equity shares. There's particularly a occupation erstwhile that CEO is costing the institution $15 cardinal successful losses annualized done forcing investments successful the metaverse, a fig that helium says is going to turn substantially successful the adjacent year.

That's for a concern that's hardly earning $2 cardinal successful gross annualized. It mightiness beryllium expandable but successful the past 2 years, it's mislaid much than $20 cardinal portion failing to grow revenue. The metaverse's active users are astir 40% of the company's target, and the institution hasn't provided a way to turning astir that conflict to summation gross and profits.

It's clip for Mark Zuckerberg to person voting shares proportional to his ownership and to fto the shareholders and different employees absorption connected investing for expansion. Until that changes, oregon his strategy changes, the institution we erstwhile thought had tremendous imaginable is astir untouchable.

Thesis Risk

The largest hazard to the thesis is Meta tin ever revamp its business. The institution tin ever code down its Realty Labs concern substantially on with superior investments, substantially improving profits and shareholder returns. That could mean that investors who don't instrumentality vantage of the existent valuation would miss out.

In a mean environment, this is simply a $300 cardinal company, earning $50 cardinal successful yearly operating income.

Conclusion

Meta Platforms has a unsocial portfolio of assets and contempt the impacts of privateness changes etc., the institution has, impressively been capable to bounce back. Revenue numbers successful advertizing particularly are really remaining stronger than Realty Labs, for example, wherever the institution is spending $10s of billions.

Going forward, we expect Meta Platforms to beryllium capable to summation shareholder rewards but Mark Zuckerberg needs to backmost up his thesis for VR/AR and absorption connected the halfway platforms. We'd similar to spot his voting percent pushed down to beryllium commensurate to his marketplace share. Until that happens oregon helium dramatically changes his absorption to beryllium semipermanent returns, we expect Meta Platforms to conflict arsenic an investment.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield harmless status portfolio, and macroeconomic outlooks, each to assistance you maximize your superior and your income. We hunt the full marketplace to assistance you maximize returns.

Recommendations from a apical 0.2% TipRanks author!

Retirement is analyzable and you lone get 1 accidental to bash it right. Don't miss retired due to the fact that you didn't cognize what was retired there.

We provide:

- Model portfolios to make precocious status currency flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and enactment strategies.

.png) 2 years ago

42

2 years ago

42

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)