Lemon_tm

We support our bargain standing connected Meta Platforms (NASDAQ:META) arsenic we judge the worst has been priced into the banal and spot Meta recovering toward 2H23. Since our past publication connected Meta successful aboriginal November, the banal has risen astir 41%.

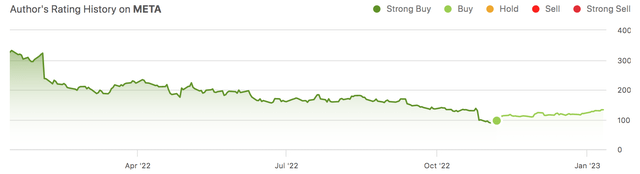

The pursuing graph outlines our standing past connected META.

We expect Meta's banal to proceed to beryllium driven higher arsenic the institution takes steps to beryllium much disciplined erstwhile managing Metaverse spending. We besides judge Meta is moving to amended engagement successful its Family Apps group. We proceed to expect the banal terms to stay volatile successful the adjacent term, but expect the sell-off past twelvemonth to supply a favorable introduction constituent into Meta arsenic a worth stock. We judge investors jumping into the banal astatine existent levels volition beryllium well-rewarded successful 2023.

Favorite prime among FANG stocks

While 2022 was a unsmooth twelvemonth for the full tech space, it deed Meta peculiarly hard, with the banal reaching a debased of $88.09 precocious past year. Our bullish sentiment connected Meta is driven by our content that Meta is simply a worth banal astatine existent levels with imaginable maturation drivers successful 2023. We expect absorption to bring its A-game to amended assemblage engagement; we've already seen this with Meta's Instagram adding the reel diagnostic to amended vie with Chinese elephantine TikTok.

While we saw tech stocks driblet crossed the committee implicit the past 15 months, we judge that portion of Meta's pullback was self-inflicted. To amended outline wherefore we expect Meta to retrieve successful 2023, we judge it's indispensable to sermon wherefore the banal is down truthful debased successful the archetypal place, addressing however these antagonistic headwinds volition beryllium flipped implicit for the banal to turn meaningfully.

1. Macroeconomic headwinds spilling into Ad spending

Macroeconomic headwinds is simply a operation that doesn't look to beryllium getting old, adjacent successful 2023. We judge Meta's pullback successful 2022 was mostly the effect of the weaker spending situation resulting from heightened inflationary pressures and spiked involvement rates. We saw advertisement spending weaken importantly successful 2022. We judge the weaker spending situation took a spot retired of Meta's advertisement revenue, which accounted for astir 49% successful 3Q22. Meta's 3Q22 earning study showed an advertisement gross diminution of astir 4% Y/Y. We judge the weaker spending played a large relation successful the ample tech banal pullback not lone for Meta but for Alphabet (GOOG) and Snap (SNAP), reporting slower advertisement gross growth. We judge the advertisement spending situation volition stay choky for the 1H23. We judge the advertisement weakness has been priced into the stock, and hence, we stay bullish connected Meta's maturation communicative successful 2023.

2. (Over)Spending connected Reality Labs

Meta's sanction alteration successful 2021 from Facebook to Meta Platforms came with a foreshadowing of monolithic spending connected Mark Zuckerberg's dreams to spearhead the travel of making the Metaverse a reality. Over the past 4 years, Meta allocated astir $36B to processing its Reality Labs project. The overspending signaled large reddish flags for investors globally arsenic the Metaverse task volition apt instrumentality years to go profitable but volition proceed deepening cognition losses connected Meta's financials. In 2021, Reality Labs mislaid $10.2B successful operational losses and different $5.8B successful the archetypal fractional of 2022. While Meta's overspending connected its Reality Labs has undoubtedly caused a dent successful Meta's stock, we're much constructive connected the banal present arsenic we expect to spot absorption signifier much disciplined spending going forward.

Currently, Meta is 1 of the apical Virtual-Reality Hardware platforms done its Oculus devices. Hence, we judge if immoderate institution is well-positioned to nett from the semipermanent concern successful the metaverse, it's Meta Platforms. We judge the company's Family Apps conception with Facebook and Instagram apps provides a currency travel to money the company's concern successful the metaverse.

We judge the banal terms volition stay volatile successful the adjacent term; we judge the worst is down for Meta. Our anticipation of a volatile banal terms is owed to the macroeconomic situation and rising costs connected each fronts. Meta's gross declined by 4% successful 3Q22. We besides believe, accordant with management's announcement successful the 3Q22 net call, overseas speech headwinds volition origin a 7% headwind connected full gross successful 4Q22. Despite this, we judge the institution is amended positioned to turn present and judge it provides a favorable risk-reward illustration aft the banal sell-off.

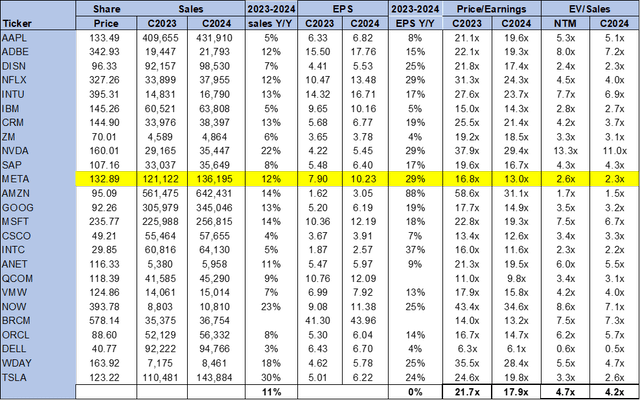

Valuation

We judge Meta Platforms is simply a worth banal trading importantly little than the adjacent radical average. On a P/E basis, the banal is trading astatine 13.0x C2024 compared to the adjacent radical mean astatine 17.9x. The banal is trading astatine 2.3x EV/C2024 versus the adjacent radical mean of 4.2x. Meta Platforms is our favourite prime among the FANG stocks astatine the moment, arsenic we judge the stock's sell-off past twelvemonth provides an charismatic introduction constituent into Meta's semipermanent growth.

The pursuing array outlines META's valuation successful the adjacent group.

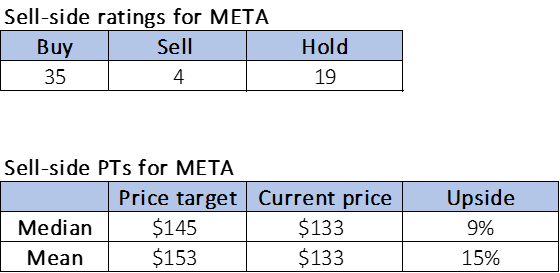

Word connected Wall Street

The bulk of Wall Street is bullish connected Meta Platforms. Of the 58 analysts covering the stock, 35 are buy-rated, 19 are hold-rated, and the remaining are sell-rated. The banal is presently priced astatine $133. The median sell-side terms people is $145, portion the mean is $153, with a imaginable upside of 9-15%.

The pursuing tables outline META's sell-side ratings and terms targets.

TechStockPros

What to bash with the stock

We're bullish connected Meta. We judge Meta is simply a worth banal trading good beneath the adjacent group. With the disappointing and expected 3Q22 earning results and the banal pullback past year, we judge Meta is astatine the bottommost and connected its mode backmost up. We're much constructive connected Meta successful 2023 arsenic we spot absorption workout much subject successful Metaverse spending. We besides expect the weakness of advertisement spending amid macro headwinds to person been priced into the banal astatine existent levels. Meta is our favourite banal successful the FANG group; hence, we urge investors bargain the banal astatine existent levels.

This nonfiction was written by

We are nonrecreational banal pickers with a proven way record, successful investments, manufacture expertise, and exertion edge. We person been top-ranked (Starmine Thomson Reuters, Factset, Institutional Investor) tech equity analysts astatine Wall Street bulges. Before our Wall Street careers, each of america worked successful the tech manufacture starting arsenic an technologist astatine assorted high-tech companies earlier yet earning an MBA. We strive to supply clear, applicable, and insightful Wall Street people cardinal probe with an investing borderline connected tech stocks. We are nonsubjective successful our appraisal of the technologies progressive and often instrumentality contrarian positions aft done probe into hype and accepted wisdom. We aspire to supply champion successful people concern probe to retail investors. We privation to level the playing tract for retail investors, by providing the best-in-class probe that is lone accessible to organization investors.

Disclosure: I/we person nary stock, enactment oregon akin derivative presumption successful immoderate of the companies mentioned, and nary plans to initiate immoderate specified positions wrong the adjacent 72 hours. I wrote this nonfiction myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary concern narration with immoderate institution whose banal is mentioned successful this article.

.png) 1 year ago

44

1 year ago

44

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)