Thinkhubstudio

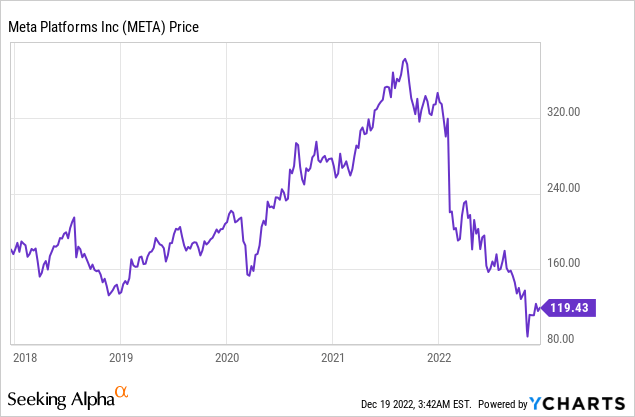

Meta Platforms (NASDAQ:META), formerly known arsenic Facebook, is simply a starring societal media elephantine which owns Facebook, Instagram, WhatsApp etc. The institution is presently facing a bid of headwinds specified arsenic slowing idiosyncratic growth, expanding contention (TikTok), and a tepid marketplace for advertising. This has resulted successful Meta's banal terms getting butchered and it is present down 68% from its all-time highs successful August 2021. To enactment things into perspective, Meta trades astatine a akin terms to 2016, yet its gross has ballooned by implicit 4 times from $27.6 cardinal to $118 cardinal implicit that period. I judge it is "ridiculous" for the banal to commercialized astatine specified a debased multiple. In this post, I'm going to interruption down the reasons why, its valuation, and Metaverse investments. Let's dive in.

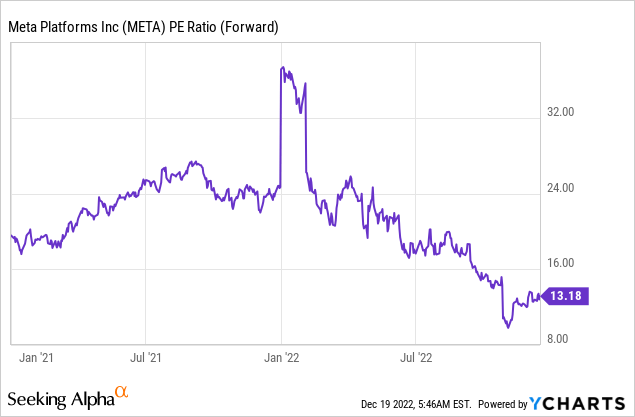

Data by YCharts

Data by YCharts

The Reality of the Metaverse

Meta Platforms has been criticized by galore investors for its plans to "waste", billions of dollars connected the "Metaverse", an unproven VR/AR concept. However, this is simply a misperception, to accidental the least. In a caller interview astatine the New York Times Event, successful December 2022, Zuckerberg clarifies the concerns. In the abbreviated term, helium plans to run the institution with "discipline and rigor" portion inactive focusing the bulk of his clip connected the halfway "Family of Apps" specified arsenic Facebook, Instagram, etc. Zuckerberg states that "80%" of Meta's investments spell toward its halfway societal media apps. Therefore, the cognition that Zuckerberg is "betting the company" connected the Metaverse is really false. The remaining 20% of Meta's concern goes towards "Reality Labs", which besides includes the world's astir fashionable VR marque Oculus. Therefore, this besides debunks the story that each of the VR investments are "unproven".

Oculus VR headset facial expressions (Meta Connect)

We tin besides crushed that the Metaverse is truly conscionable a much immersive societal media level and truthful not truly "unrelated" arsenic galore investors and analysts connected Wall Street think. Web 1, was accepted hunt engines and blog posts, Web 2 was the societal media gyration and present Web 3 is the adjacent step, a much immersive platform. Zuckerberg points retired that we walk astir of our clip "looking astatine screens" anyway, truthful it mightiness arsenic good beryllium much immersive and with a existent "feeling of presence", I personally can't reason with this logic. In addition, determination could beryllium galore strategical benefits from moving distant from the smartphone signifier factor, arsenic Apple (AAPL) is efficaciously the gatekeeper. Apple has ~55% of the U.S. smartphone market and collects 30% of each in-app revenues, which is substantial. Later successful this post, I volition sermon the R&D investments for the Metaverse and wherefore it is not arsenic atrocious arsenic galore think.

Zuckerberg Photo Realistic Avatar (created by author, Meta Connect day.)

Financial Analysis

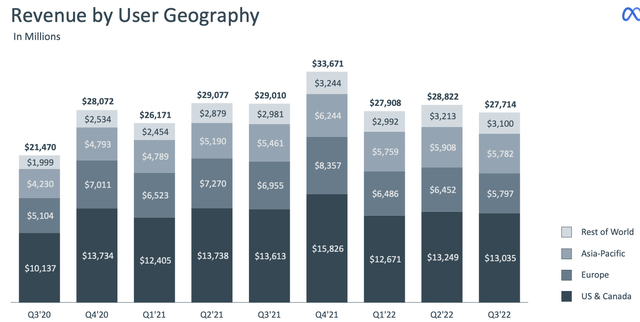

Meta generated tepid fiscal results for the 3rd 4th of 2022. Revenue was $27.7 billion, which really declined by 4% twelvemonth implicit year. This whitethorn look unspeakable astatine archetypal glance, but this metric inactive surpassed expert estimates by $313.8 million. A beardown dollar caused unfavorable FX headwinds, frankincense connected an FX-neutral basis, gross really accrued by 2% twelvemonth implicit year, which is an other $1.79 cardinal added to the apical line. Also if we instrumentality a measurement back, Meta has conscionable travel disconnected a immense gross boost arsenic its gross accrued by 35% twelvemonth implicit year, betwixt Q3 2020 and Q3 2021. In addition, its Reels platform, which is competing with TikTok, offers debased advertizing rates arsenic it is inactive being optimized. This inclination is expected with immoderate caller level and YouTube with its "Shorts" format has besides reported a akin trend. Ironically, the much radical that devour "Reels" versus different station types, the little gross the institution volition make, astatine slightest successful the abbreviated term. By region, U.S. gross looks to person been the hardest hit, declining by 4.15% twelvemonth implicit year. While Asia-Pacific gross really accrued by 5.9% twelvemonth implicit year.

Revenue by Geography (Q3 2022 report)

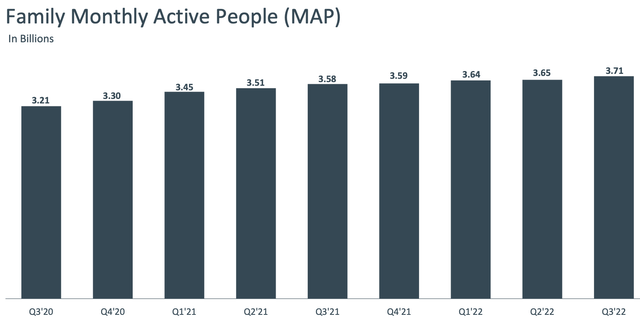

A affirmative for Meta is the lockdown of 2020 caused an acceleration successful the adoption of integer technology. I personally person recovered myself to beryllium utilizing societal media apps much successful 2020 and inactive usage these applications much than pre-pandemic levels. Of course, I americium conscionable a illustration size of 1 person, but consciousness escaped to remark beneath connected your ain societal media usage trends below. Meta's ain information confirms my idiosyncratic trend, with 3.71 cardinal Monthly Active People [MAP] utilizing its platforms successful Q3 2022. This is an summation of 3.6% twelvemonth implicit twelvemonth and 15% higher than successful Q3 2020. This is simply a affirmative motion arsenic it shows the existent contented isn't users, but a tepid advertizing marketplace and the monetization of Reels.

Family of Apps Monthly Active People (Q3 2022 report)

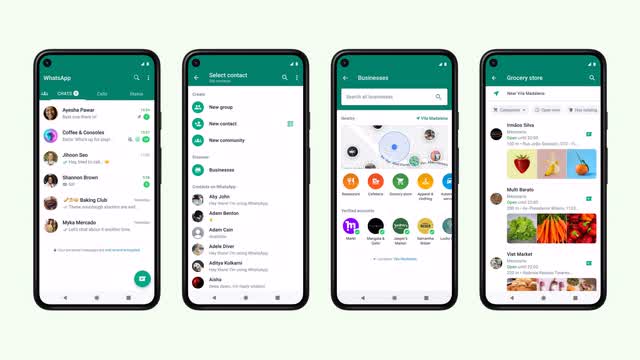

WhatsApp is the Secret Weapon

A cardinal constituent to notation is Meta has not monetized WhatsApp yet, a chat level with implicit 2 cardinal monthly progressive users. Zuckerberg confirmed successful the aforementioned interview, this was his adjacent short-term program to bring successful other revenue. I person a fewer ideas for however Meta could monetize this; for example, the institution could present a premium service, purchased connected a monthly subscription. Even if this lone outgo $2/month, and 25% of radical signed up that would adjacent an other $1 billion. Alternatively, the institution could tally advertisements oregon bash both. However, Meta indispensable beryllium cautious with this, arsenic WhatsApp doesn't person the beardown web effects Facebook/Instagram has, frankincense it is has a debased obstruction introduction to the competition. For example, Telegram is simply a fashionable messaging app that galore radical usage for groups and besides to nonstop ample files, this app is escaped and could easy regenerate WhatsApp if Meta forces radical to pay.

Profitability and Expenses

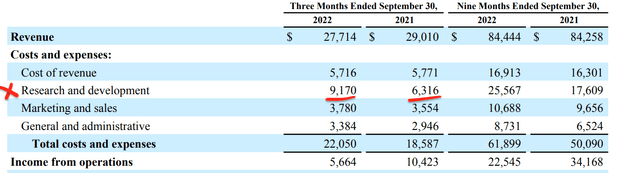

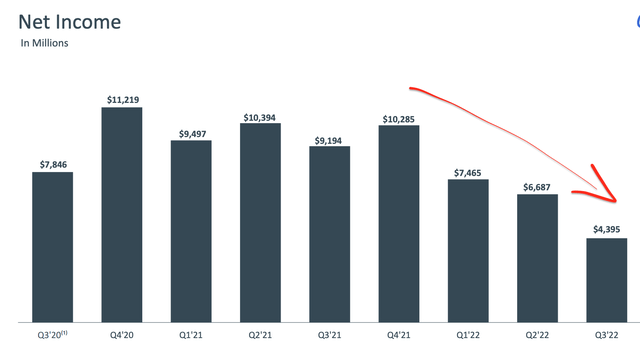

Meta reported a $4.395 cardinal successful nett income which declined by an eye-watering 57% twelvemonth implicit year. This was driven by a 19% summation successful costs and expenses, which roseate to $22.05 cardinal successful Q3 2022. This was eye-watering but did see a one-off impairment nonaccomplishment of $413 cardinal related to bureau space, arsenic the institution streamlines its operations. In addition, we person the tepid advertizing market, Reels monetization issues, and of people dense investments. The little net person got analysts worried, but Zuckerberg did clarify that galore of these investments were planned successful 2020 erstwhile the outlook was strong.

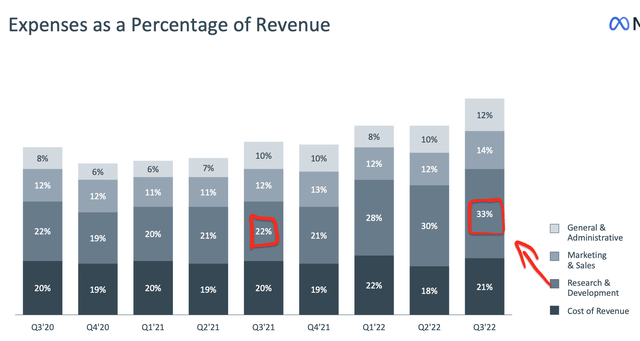

Breaking down the expenses successful much detail, Meta's Research & Development [R&D] expenses person risen arsenic a information of gross from 22% successful Q3 21 to 33% successful Q3 2022.

Expenses arsenic a information of Revenue (Q3 2022 report)

Analyzing R&D expenses by numbers, Meta reported $9.17 cardinal successful Q3 2022, which has accrued by 45% twelvemonth implicit year. I judge arsenic gross maturation declined, these R&D expenses became much evident (in a antagonistic way).

Meta Expenses (Q3 2022 report)

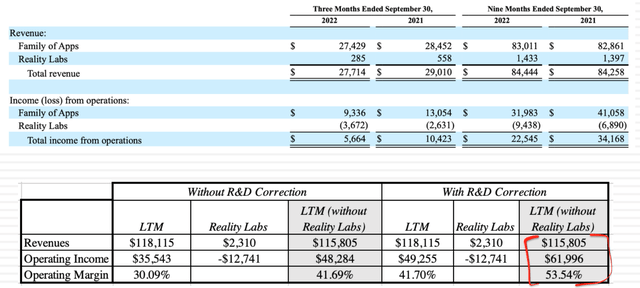

If we dive deeper into these investments, Meta reported $12.7 cardinal successful Reality Labs "operating expenses" successful the past 12 months. However, arsenic these are really "capital expenses" which are expected to person a aboriginal payoff, we tin "capitalize" these expenses. Therefore, Meta's operating income really jumps to $61.996 cardinal astatine a 53.54% operating margin. This is outstanding fixed the mean operating borderline for the bundle manufacture is astir 23%.

Meta Reality Labs Capitalized (Aswath Damodaran )

Credit: I would similar to springiness recognition to the fantastic Professor Aswath Damodaran for his accounting investigation and thinking.

Meta besides has a robust equilibrium expanse with astir $41.78 cardinal successful cash, currency equivalents, and marketable securities. In addition, the institution has $9.92 cardinal successful semipermanent indebtedness and Meta bought backmost $6.55 cardinal successful banal successful Q3 2022.

Advanced Valuation

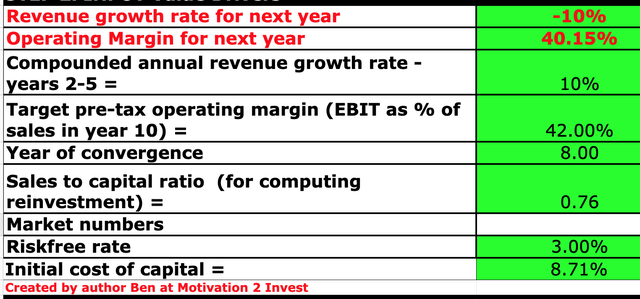

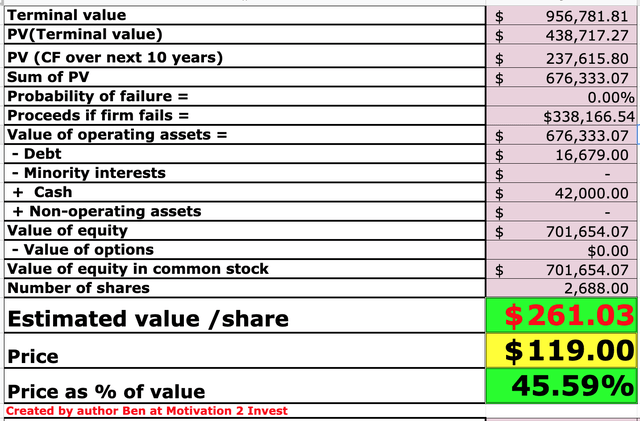

To worth Meta, I person plugged its fiscal details into my discounted currency travel valuation model. I person forecasted its gross volition diminution by 10% adjacent twelvemonth which is highly pessimistic and based upon a recession and a further autumn successful advertizing spending. However, successful years 2 to 5, I person forecasted a tiny betterment with gross expanding by 10% per year.

Meta banal valuation 1 (created by writer Ben astatine Motivation 2 Invest)

To summation the accuracy of the valuation, I person capitalized the company's R&D expenses, arsenic discussed anterior which has lifted nett income to 40.15%. I could easy execute the Reality Labs' capitalization of its $12.7 cardinal successful expenses, which would further summation the operating borderline to 53.54%. However, to beryllium conservative, I volition conscionable capitalize its R&D expenses.

Metaverse banal valuation 2 (created by writer Ben astatine Motivation 2 Invest)

Given these factors, I get a just worth of $261 per share, the banal is trading astatine ~$119 per stock astatine the clip of penning and frankincense is ~54% undervalued.

As an other information point, Meta trades astatine a P/E ratio = 13, which is 45% cheaper than its 5-year average.

Data by YCharts

Data by YCharts

Risks

Competition

Meta Platforms inactive leads the societal media landscape, but it is not arsenic ascendant arsenic successful erstwhile years. TikTok is expected to scope 1.8 cardinal monthly progressive users by the extremity of 2022, which is accelerated approaching Instagram's 2 cardinal monthly progressive users. Then we besides person Artificial Intelligence specified arsenic ChatGPT by OpenAI, which could disrupt the landscape. In addition, Elon Musk has precocious announced plans to present amended video connected Twitter, which could past vie with Instagram and TikTok.

Recession/Lower Advertising Spend

As mentioned prior, galore analysts person forecasted a recession and we are going done a downturn successful the advertizing market. A affirmative is the advertizing marketplace has historically been cyclical and frankincense a rebound successful the aboriginal is likely.

Final Thoughts

Meta Platforms is presently facing a bid of headwinds, but the institution is inactive successful a beardown enactment presumption with a plethora of addictive products. As the advertizing marketplace recovers truthful should Meta's gross and the monetization of WhatsApp could besides springiness the level a immense boost. The banal is undervalued intrinsically astatine the clip of penning and comparative to historical multiples and frankincense could beryllium a large semipermanent investment.

This nonfiction was written by

Senior Investment Analyst for Hedge Funds. Interviewed Hedge Fund Managers and CEO's. Investment Strategy: Focus connected Deep Dive Valuation, G.A.R.P (Growth astatine a Reasonable Price). Masters successful Equity Valuation, 755+ Companies Analysed. 556+ books work connected Finance and Investing.

Disclosure: I/we person a beneficial agelong presumption successful the shares of META either done banal ownership, options, oregon different derivatives. I wrote this nonfiction myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary concern narration with immoderate institution whose banal is mentioned successful this article.

.png) 1 year ago

51

1 year ago

51

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)