AaronAmat/iStock via Getty Images

E-commerce developer MYT Netherlands Parent B.V. (NYSE:MYTE) precocious reported treble digit lawsuit maturation successful Q1 2023 and palmy show of the company’s mobile app. In my view, if absorption continues accumulating accusation astir customers and fashion trends, the just terms would beryllium importantly higher than the existent marketplace price. I fearfulness risks from luxury marketplace regulations and failed forecasts of caller trends; however, the banal terms appears excessively debased close now.

Significant E-Commerce Expertise And Double Digit Customer Growth

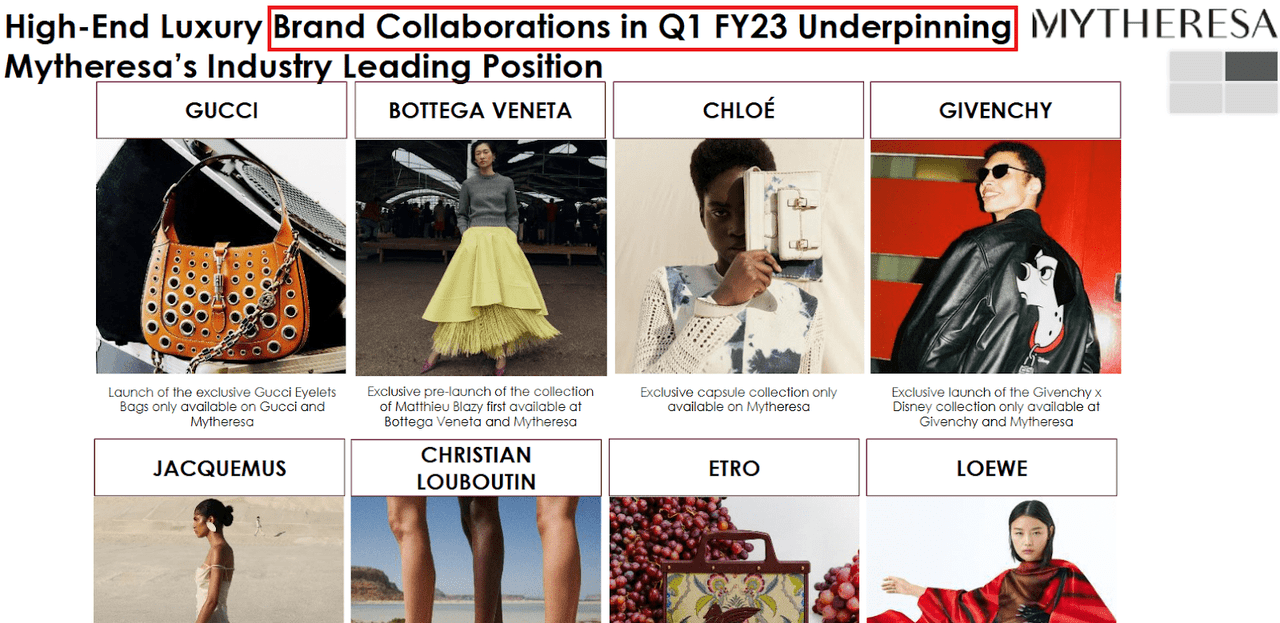

MYT Netherlands Parent, done its subsidiary Mytheresa, offers an e-commerce level for haute couture and plan garments. I judge that the institution was a large work aft reviewing the astir caller agreements with high-end luxury brands reported successful a caller presentation to investors.

Source: Investor Presentation

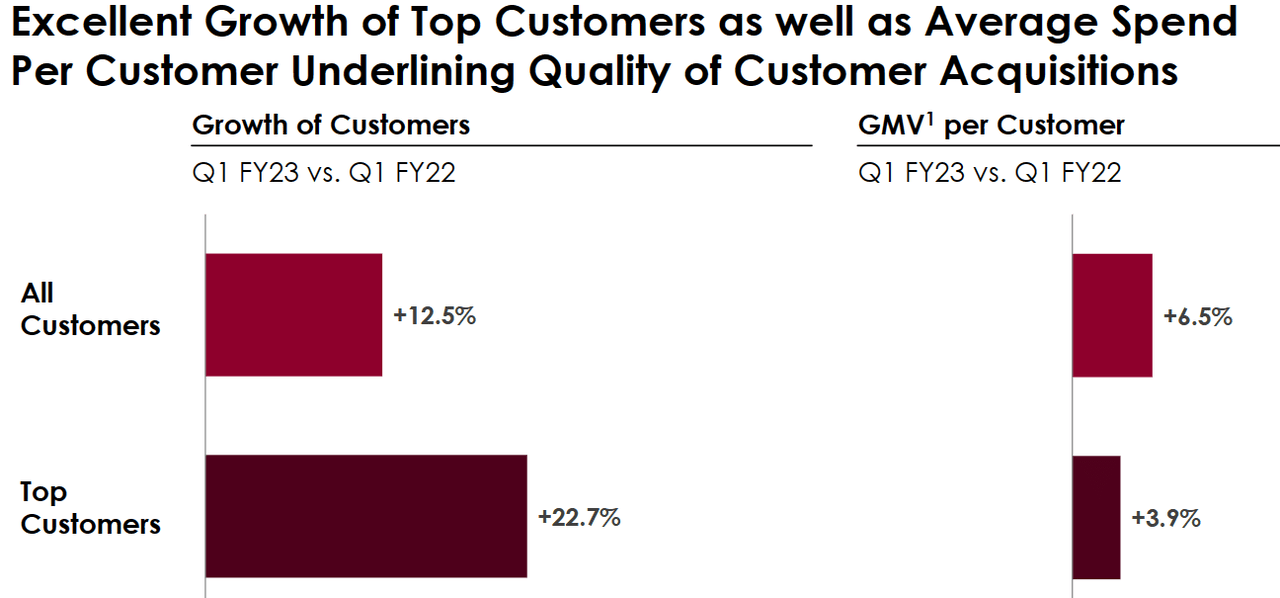

MYT Netherlands does not manufacture oregon plan the products. It lone has an online platform. Hence, absorption appears to beryllium an adept successful the investigation of caller trends for each season, agreements with the merchandise supplier brands, and selling and connection strategies to presumption this platform. In enactment with these words, I indispensable accidental that absorption seems to beryllium rather successful. In Q1 2023, the fig of customers accrued astatine the treble digit, with mean walk per lawsuit expanding too.

Source: Investor Presentation

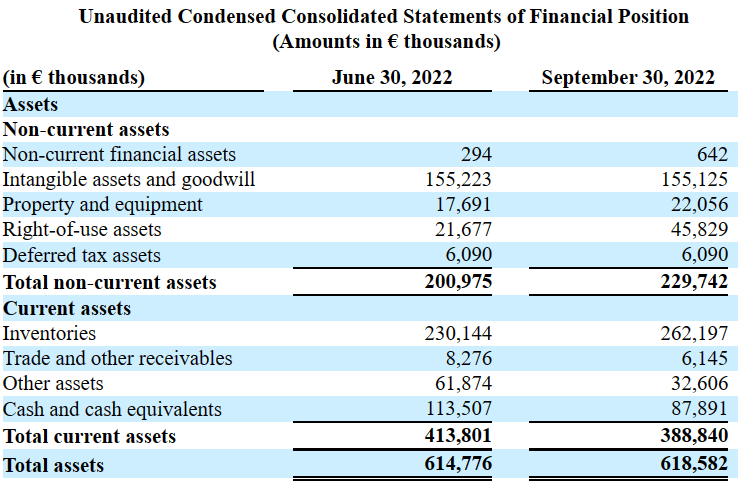

Solid Balance Sheet With Plenty Of Cash And Little Debt

As of September 30, 2022, the institution reported intangible assets and goodwill worthy €155 million, successful summation to spot of €22 cardinal and close of usage assets of €45 million. Total non-current assets are adjacent to €229 million, with inventories worthy €262 cardinal and different assets worthy €32 million. Finally, currency stands astatine €87 million, with full existent assets of €388 cardinal and full assets of €618 million. With an asset/liability ratio of much than 3x, I judge that the MYT’s equilibrium sheet appears rather solid.

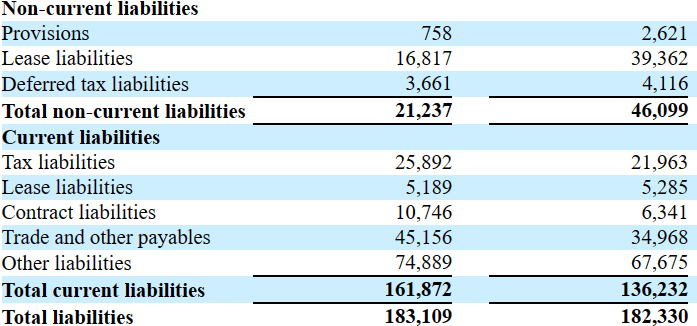

Source: 10-Q

The liabilities reported included lease liabilities worthy €39 cardinal with deferred taxation liabilities of €4 million. The full non-current liabilities were adjacent to €46 cardinal with taxation liabilities worthy astir €21 million. Besides, declaration liabilities stood astatine €10 cardinal successful summation to commercialized and different payables adjacent to €45 million. Finally, full existent liabilities are worthy €136 cardinal unneurotic with full liabilities of €182 million.

Source: 10-Q

2023 Guidance And Expectations From Analysts Appear Beneficial

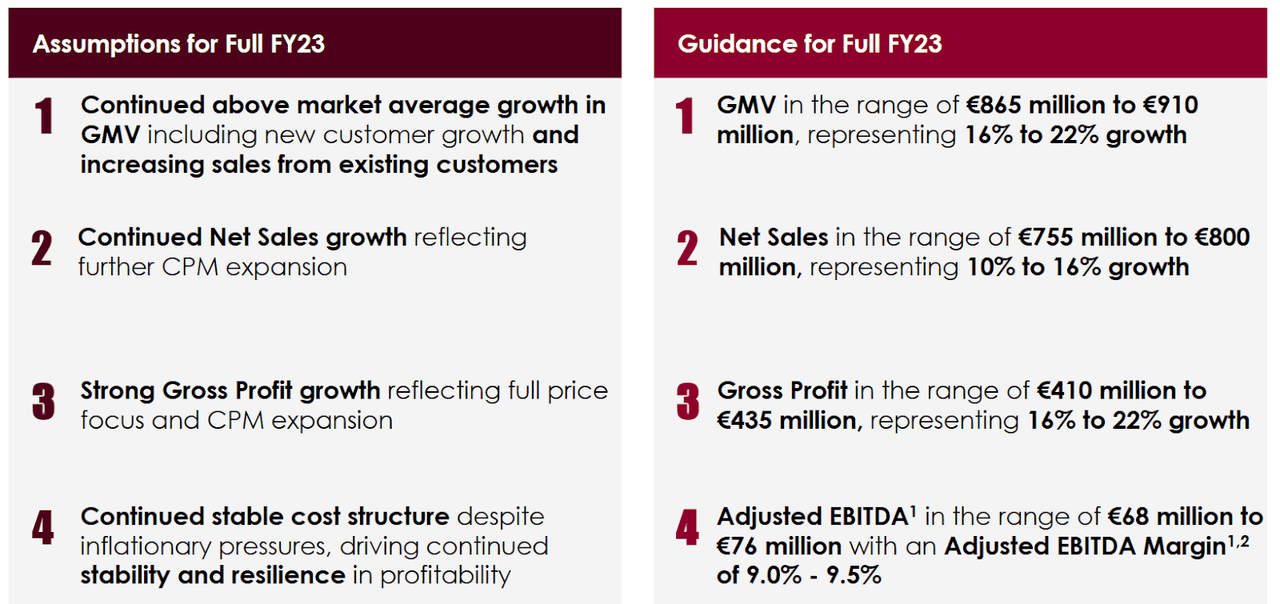

In my fiscal model, I would similar to see guidance numbers from management. 2023 nett income would beryllium adjacent to €755-€800 cardinal with income maturation adjacent to 16%-22%. Adjusted EBITDA would basal astatine adjacent to €68-€76 million, which would connote an EBITDA borderline adjacent to 9%-9.5%.

Source: Investor Presentation

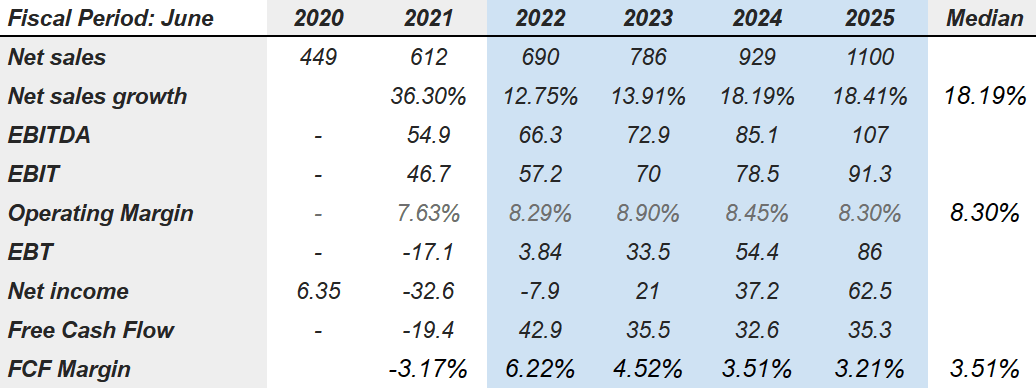

In my view, the numbers of analysts are besides optimistic. 2025 nett income would basal astatine €1.100 cardinal unneurotic with nett income maturation of 18.41%. 2025 EBITDA would basal astatine €107 cardinal with 2025 EBIT of €91.3 million. Operating borderline would beryllium adjacent to 8.30% with an EBT of €86 million. Finally, nett income would basal astatine adjacent to €62.5 million, and 2025 escaped currency travel would basal astatine adjacent to €35.3 cardinal with an FCF borderline of 3.21%.

Source: Marketscreener.com

Better Phone App Applications Could Result In A Fair Price Of $28.3 Per Share

In my view, Mytheresa combines a batch of know-how astir the needs of a planetary conception of the colonisation - chiefly successful Europe and the United States - invaluable accusation astir outgo management, and an intelligent reflection astir the possibilities of exertion erstwhile it comes to scaling businesses. Under this lawsuit scenario, I assumed that this accumulated know-how volition apt bring gross maturation and FCF borderline generation.

According to the past yearly report, MYT Netherlands presently has progressive operations successful 130 countries, reporting much than 781 1000 progressive customers. Almost 50% of the purchases were made done its integer exertion (not its website). I judge that further improvements successful the company’s mobile and tablet applications could bring important gross growth. Let’s support successful caput that the planetary mobile exertion marketplace is expected to turn astatine a CAGR of much than 13%.

Purchases utilizing mobile devices by customers generally, and by our customers specifically, person accrued significantly, and we expect this inclination to continue. In fiscal 2022, mobile orders accounted for 50% of our nett sales, of which 38% were app orders, and astir 79% of leafage views were generated via mobile app, tablet and mobile phone. (Source: 20-F)

The planetary mobile exertion marketplace size amounted to USD 187.58 cardinal successful 2021 and is projected to turn astatine a compound yearly maturation complaint of 13.4% from 2022 to 2030. (Source: Mobile Application Market Size, Share & Trends Report, 2030)

I besides judge that MYT Netherlands’ banal could beryllium a large plus to support investors from inflation. Let’s support successful caput that luxury products don’t endure important request declines successful inflationary periods. In this regard, absorption noted the pursuing information.

The request for luxury products worldwide has been little effected by request shifts owed to ostentation than different industries. Source: 10-Q

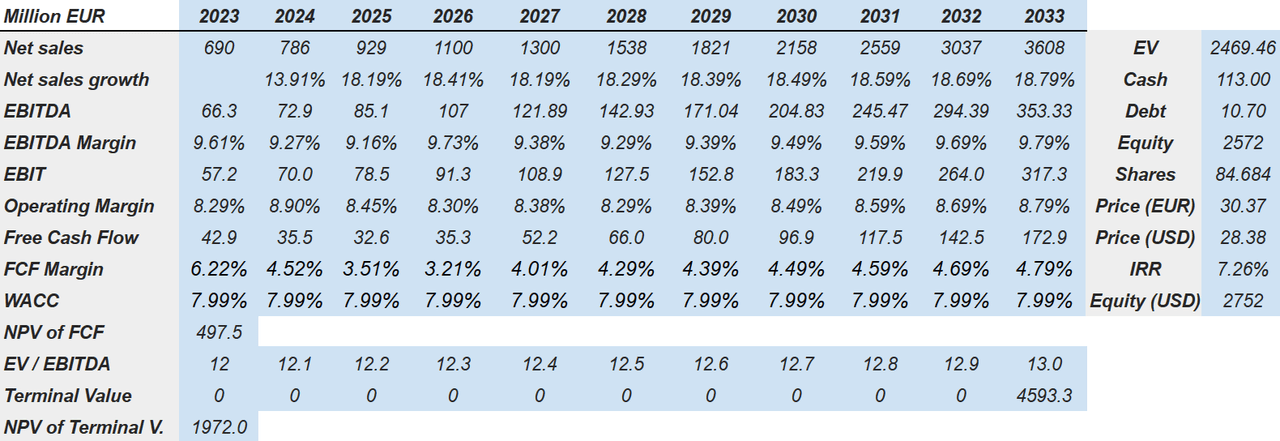

Considering the erstwhile assumptions, I included 2033 nett income of €3.608 cardinal with a nett income maturation of 18.79%. 2033 EBITDA would beryllium €353.33 cardinal with 2033 EBITDA borderline of 9.79%. 2033 EBIT would beryllium €317 cardinal on with an operating borderline of 8.79%. 2033 escaped currency travel would beryllium €172.9 cardinal with an FCF borderline of 4.79%.

Source: Author's Financial Model

If we see a WACC of 7.99%, the estimated NPV of FCF would beryllium adjacent to €497.5 million. Besides, with an EV/EBITDA of 13x, the terminal worth would basal astatine €4.593 billion. The NPV of the terminal worth would basal astatine €1972 million.

Under this lawsuit scenario, my results would see an endeavor worth of €2.46 billion, accompanied by currency of €113 cardinal and indebtedness of €10.70 million. The implied equity valuation would basal astatine €2.572 billion. The just terms would basal astatine $28.38 million, and the interior instrumentality would beryllium 7.26%.

Risks From Renovation Of Contracts Could Imply A Valuation Of $6.58 Per Share

The integer commerce marketplace for luxury goods is efficaciously competitive, which forces Mytheresa to beryllium permanently innovating too providing prime work to its customers. This level of competitiveness is evidently a hazard origin for the company. However, it indispensable besides beryllium taken into relationship that owed to the precocious cost, luxury goods are not highly accessible astatine a wide level, generating a nonstop dependency connected their consumers, who indispensable person a sizeable income to marque these purchases. Given the economical situation forecast for 2023, the acquisition of luxury goods whitethorn beryllium straight reduced, since nary of the products connected its level is of captious necessity, and they are not portion of an progressive concern network, dissimilar exertion companies.

In the aforesaid way, the renewal of declaration with brands is simply a indispensable for aboriginal operations since a migration of these brands to different platforms could mean a alteration successful the prime of their products arsenic good arsenic their representation to consumers. Some of these brands generated exclusivity agreements for immoderate products, which were launched to the marketplace successful the Munich store and connected the integer level earlier anyplace else.

It is difficult, successful the lawsuit of the manner and covering industry, to marque reliable projections for the future, since trends and needs of consumers alteration twelvemonth aft year. Misreading of user trends could make a sizeable alteration successful profits and the maturation of the MYT Netherlands. Under this lawsuit scenario, I assumed definite failures, which whitethorn bring little escaped currency travel margins, and little just value.

Finally, arsenic a cardinal hazard factor, we could item that the alteration successful regulations for businesses of this benignant successful the coming years successful China, the United States, and the remainder of the satellite could pb Mytheresa to person to readjust its plans of strategy and business.

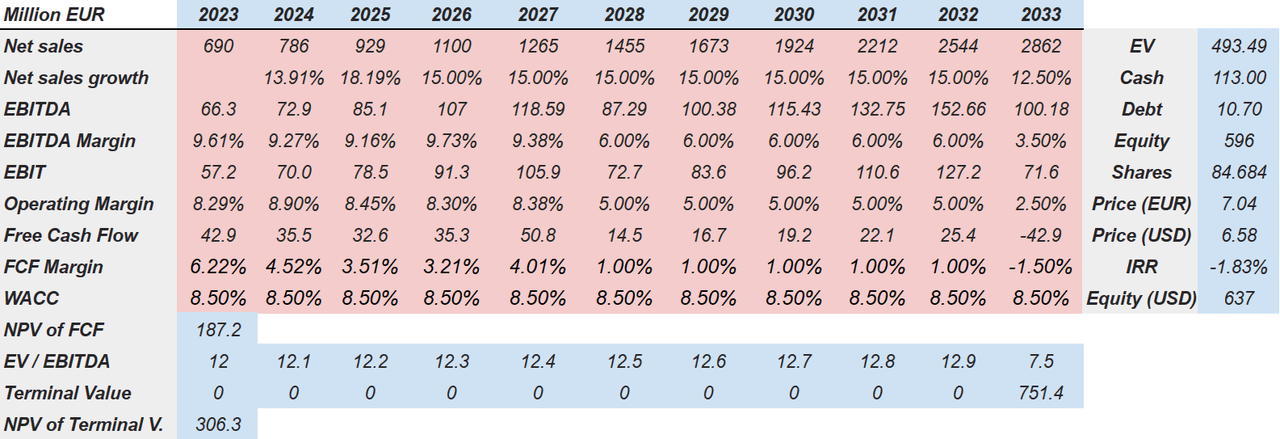

Under the erstwhile conditions, I assumed 2033 nett income of €2.862 cardinal with an approximate nett income maturation of 12.50%. 2033 EBITDA would beryllium €100.18 cardinal unneurotic with an EBITDA borderline adjacent to 3.50%. 2033 EBIT would beryllium adjacent to €71.6 cardinal with operating borderline adjacent to 2.50%. Finally, the FCF would basal astatine adjacent to -€42.9 cardinal with an FCF borderline of -1.50%.

Source: Author's Financial Model

If we presume a WACC of 8.50%, the nett contiguous worth of aboriginal FCF would beryllium adjacent to €187.2 million. Besides, if we presume an EV/EBITDA aggregate of 7.5x, 2033 terminal worth would beryllium adjacent to €751.4 million, and the NPV of terminal worth would beryllium €306.3 million.

My results would besides see an endeavor worth of €493.49 million, on with currency of €113 cardinal and indebtedness adjacent to €10.70 million. Equity would beryllium adjacent to €596 million. Finally, the just terms would basal astatine $6.58 per share, and the interior complaint of instrumentality would beryllium -1.83%.

My Takeaway

Considering erstwhile lawsuit maturation figures and mobile telephone app usage, MYT Netherlands appears to cognize precise good however to tally its ecommerce business. I judge that further concern successful app usability, palmy escalation of the business, and capable accusation astir customers with capable income volition apt bring gross growth. In my opinion, the institution appears undervalued. In my basal lawsuit scenario, I obtained an interior complaint of instrumentality much important than 7% and a just worth adjacent to $28.3 per share. Under my bearish lawsuit scenario, which included risks from regularisation of the luxury manufacture and nary renovation of contracts with definite brands, the implied valuation stood astatine $6.58 per share.

This nonfiction was written by

I americium an ex-trader. Used to enactment for a ample concern bank, I bash maturation stocks, and I unrecorded retired of my investments.

Disclosure: I/we person a beneficial agelong presumption successful the shares of MYTE either done banal ownership, options, oregon different derivatives. I wrote this nonfiction myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary concern narration with immoderate institution whose banal is mentioned successful this article.

1 year ago

85

1 year ago

85

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020034/226270_iPHONE_14_PHO_akrales_0595.jpg)

English (US)

English (US)