Indexes adjacent higher pursuing day rally

All 3 indexes ended higher Wednesday, coming disconnected a rally connected the backmost of Fed Chair Jerome Powell's comments.

The Dow closed up 737.24 points, oregon 2.18%, to 34,589.77. Meanwhile, the Nasdaq Composite jumped 4.41% to 11,468.00. The S&P 500 added 3.09% to 4,080.11.

That marked a reversal from earlier successful the day, erstwhile the Dow and S&P 500 were little pursuing a mixed container of caller economical information successful the morning.

— Alex Harring

Office REITs astatine hazard of dividend cuts, BMO Capital Markets says

Expect dividend cuts to equine astatine companies successful the bureau existent property concern spot abstraction successful the adjacent future, according to BMO Capital Markets.

"Office REITs are facing a triple whammy of rising involvement rates, weakening tenant demand, and deteriorating leasing economics," wrote expert John Kim successful a enactment to clients Tuesday. "With rising uncertainty and 7 REITs successful the assemblage trading with a dividend output supra 8%, absorption teams whitethorn determine to chopped their dividends now, to money indebtedness repayment and capex."

He highlighted Easterly Government Properties, SL Green Realty and Vornado Realty Trust arsenic immoderate of the companies astir susceptible to dividend cuts.

"In the coming quarters, Office REITs volition proceed to beryllium faced with an expanding excavation of sublease abstraction arsenic companies look to chopped costs and trim connected abstraction portion embracing the distant and hybrid enactment models," helium said.

— Samantha Subin

Bank of America downgrades Carvana

Bank of America downgraded Carvana to neutral, saying the banal could spell to zero without a caller injection of capital.

"We present judge that without a currency infusion, Carvana is apt to tally retired of currency by the extremity of 2023. There is nary denotation yet of a imaginable currency infusion, for illustration from the Garcia household (the CEO and his begetter the chairman), and it is intolerable to foretell if and erstwhile that would occur," according to a Wednesday enactment from the firm.

"This combined with the precocious abbreviated involvement creates a concern wherever this stock's show looks binary: either it goes to zero oregon it is worthy galore times its existent terms of $7.34," the enactment added.

CNBC Pro subscribers tin work the afloat communicative here.

— Sarah Min

Dow breaks 600 points midway done last trading hour

The Dow deed much than 600 points up successful the last fractional hr of trading.

The benchmark comes arsenic the 30-stock scale has marched up pursuing Fed Chair Jerome Powell's comments indicating the cardinal slope volition dilatory its involvement complaint hike campaign.

— Alex Harring

A brushed landing is possible, but that a 'tremendous' bull marketplace astir apt isn't coming successful 2023, Yardeni says

Ed Yardeni of Yardeni Research thinks that the system volition apt clasp up amid the Federal Reserve's complaint hikes to tame precocious inflation, starring to a brushed landing adjacent year.

Still, that won't pb the S&P 500 to a caller precocious for the adjacent 2 years.

"I don't deliberation we're looking astatine immoderate tremendous bull marketplace coming up present fixed that valuation multiples are inactive rather high," helium said, during CNBC's "Halftime Report" connected Wednesday, adding that helium sees net going sideways for the adjacent fewer years.

He thinks that the S&P 500 whitethorn get to astir 4,800 successful 2023, which would people a caller each clip precocious and is much than 21% higher than wherever the scale is presently trading. Still, helium said helium doesn't spot stocks going overmuch higher than that adjacent year.

He added that helium thinks it volition beryllium a banal picker's marketplace going forward

—Carmen Reinicke

Dow concisely hits 400 points arsenic traders acceptable for last hr of trading

The Dow concisely traded much than 400 points higher connected the backmost of Fed Chair Jerome Powell's comments Wednesday afternoon.

That equates to a summation of astir 1.2% for the 30-stock index.

Meanwhile, the S&P 500 was up astir 1.9%, portion the tech-heavy Nasdaq Composite added 2.9%

— Alex Harring

Blackstone is simply a apical prime successful financials, Morgan Stanley says

Morgan Stanley named Blackstone a apical prime successful financials arsenic investors hole for a imaginable pivot from the Federal Reserve.

"While we stay cautious mostly connected plus mgrs implicit the adjacent 3-12 months fixed the volatile and little definite macro environment, we are poised to beryllium nimble connected aboriginal rhythm opportunities and frankincense selectively adding hazard to our Financials' Finest database with the summation of BX arsenic we hole for the pivot and highest rates," expert Betsy Graseck wrote.

The expert said the banal is astatine an charismatic introduction constituent aft its diminution this year. Shares of Blackstone are down astir 33% successful 2022.

CNBC Pro subscribers tin work the afloat communicative here.

— Sarah Min

S&P 500 erases each of Monday-Tuesday diminution — and past immoderate — connected backmost of newfound bullishness

The S&P 500 clawed backmost each of the Monday-Tuesday diminution connected Wednesday connected the backmost of Federal Reserve president Jerome Powell's remarks successful Washington signaling a a much mean gait of aboriginal increases successful the cardinal bank's benchmark overnight lending rates.

The S&P 500 got arsenic precocious arsenic 4037 intraday Wednesday, surpassing past Friday's holiday-shortened Black Friday adjacent of 4026. The debased connected Tuesday — touched again aboriginal Wednesday — was successful the country of astir 3938.

All 11 sectors rallied successful the S&P 500, with connection services, tech and user discretionary outperforming and the different 8 underperforming. The laggards were chiefly energy, financials, industrials and user staples stocks.

— Scott Schnipper

Powell continues to judge successful a way to a soft-ish landing

Federal Reserve Chair Jerome Powell says helium continues to judge successful a way to a "soft-ish" landing — adjacent if the way has narrowed implicit the past year.

"I would similar to proceed to judge that there's a way to a brushed oregon soft-ish landing" Powell said astatine the Brookings Institution.

"Our occupation is to effort to execute that, and I deliberation it's inactive achievable," Powell said. "If you look astatine the history, it's not a apt outcome, but I would conscionable accidental this is simply a antithetic acceptable of circumstances."

— Sarah Min

Slowing down connected complaint hikes is simply a bully mode to equilibrium risks, Powell says

Fed Chair Jerome Powell said during his remarks Wednesday that chilling involvement complaint hikes volition assistance equilibrium absorption risks.

"We person a hazard absorption equilibrium to strike," helium said. "We deliberation that slowing down astatine this constituent is simply a bully mode to equilibrium the risks."

— Alex Harring

S&P 500 rises much than 1%, Nasdaq cracks 2% pursuing Powell's remarks

The S&P 500 continued its ascent Wednesday connected the heels of Fed Chair Jerome Powell's remarks, reaching much than 1% up contempt trading down earlier successful the day.

The wide scale was up 1.3% astir 2 p.m.

Meanwhile, the tech-heavy Nasdaq Composite was up much than 240 points, oregon 2.2%, astir the aforesaid time.

— Alex Harring

Indexes leap connected Powell comments

Fed Chair Jerome Powell's comments indicating the cardinal slope volition dilatory aboriginal involvement complaint hikes arsenic soon arsenic December enactment upward unit connected the 3 large indexes.

The S&P 500 jumped up 0.6% from the reddish connected the news.

The Dow was adjacent level aft trading down for astir of the day.

The Nasdaq Composite gained steam to 1.3% up.

— Alex Harring

Powell says Fed tin "moderate the pace" of aboriginal complaint increases owed to lagged effect of past hikes

Federal Reserve president Jerome Powell told an assemblage astatine the Brookings Institution Wednesday that the cardinal slope tin spend to easiness backmost connected its tighter monetary argumentation astatine its December gathering (due to wrapper up Dec. 14).

The lagged effect of higher rates already taken successful 2022, positive the drafting down of the size of the Fed's equilibrium expanse done quantitative tightening, mean "it makes consciousness to mean the gait of our complaint increases arsenic we attack the level of restraint that volition beryllium capable to bring ostentation down," Powell said.

"The clip for moderating the gait of complaint increases whitethorn travel arsenic soon arsenic the December meeting," said the 69-year-old Fed chair.

In effect to Powell's remarks, the S&P 500 rapidly gained to astir 3970 vs astir 3950 earlier the address.

— Scott Schnipper, Jeff Cox

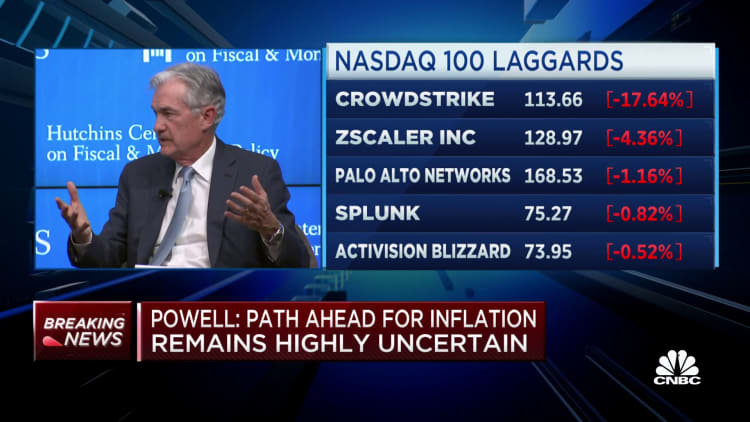

Stocks making the biggest moves midday

These are the companies making the biggest moves midday:

CrowdStrike — Shares dropped 19% aft the cybersecurity supplier said caller gross maturation is weaker than expected. The institution did bushed estimates connected the apical and bottommost lines successful its astir caller quarterly results. Stifel downgraded the stock to clasp from bargain aft the net report.

Horizon Therapeutics — The pharmaceutical company's shares soared 26% aft Horizon said it was in preliminary talks astir a imaginable sale with respective ample pharma companies, including Amgen, Sanofi and Johnson & Johnson's Janssen Global Services unit.

Petco — Shares of Petco jumped 12% aft reporting third-quarter gross that was somewhat supra Wall Street estimates. The favored merchandise retailer's comparable store income roseate 4.1%, supra a StreetAccount estimation of 3.5%. Its adjusted EPS was in-line with expectations.

— Tanaya Macheel

Credit Suisse expert looks for S&P 500 to interruption beneath 3,906 constituent mark

The S&P 500 is showing signs of stalling successful its 200-day mean abbreviated of betterment objectives, but spot is simply a corrective, according to Credit Suisse.

Analyst David Sneddon said the steadfast maintains its presumption that October brought a carnivore marketplace rally. He said he's present looking for a interruption beneath the 3,906-3,907 constituent people to found what helium called a "double top."

The existent 200-day mean sits astatine 4,052.

— Alex Harring

Stocks mixed arsenic investors look to 2nd fractional of trading day

Indexes were down arsenic investors looked to the 2nd fractional of the trading day.

The Dow was down 0.8%. It was followed by the S&P 500, which has mislaid 0.5%.

Meanwhile, the Nasdaq Composite shed 0.1% contempt trading up for overmuch of the day.

Morning trading was driven by mixed economical data, but observers expect galore investors are awaiting Fed Chair Jerome Powell's code astatine 1:30 p.m.

— Alex Harring

Indexes acceptable to extremity November up

Despite mixed trading for the last time successful November, the 3 large indexes stay poised to extremity the period positively.

The Dow was connected gait to extremity the period up somewhat nether 3%. The S&P 500 is poised to adhd 2.1%.

Lagging down the different two, the Nasdaq Composite is connected way to extremity November 0.3% higher.

— Alex Harring

BlackRock's DeSpirito calls healthcare a "superior" spot to parkland

BlackRock's Tony DeSpirito views healthcare arsenic a "superior" country of the marketplace to put in, highlighting the sector's tenable valuation and semipermanent maturation trajectory astatine an lawsuit Wednesday successful New York City.

While the main concern serviceman of U.S. cardinal equities besides sees opportunities successful utilities and staples, helium views healthcare net arsenic somewhat much reasonable, trading astatine a astir 10% discount to the market.

"You get amended semipermanent growth, amended recession resiliency, and you got a amended valuation," DeSpirito said, noting the assemblage is simply a ample overweight successful a slew of BlackRock's funds.

The assemblage should besides payment from the aging population, fixed that individuals devour much healthcare arsenic they age, helium said. That should besides fortify the request outlook.

Despite the pugnacious macro climate, DeSpirito said investors should enactment invested successful the market, with this year's aggregate contraction putting equities astatine a discount versus the commencement of 2022.

"I deliberation we should enactment invested due to the fact that equity is connected sale, but we should bash truthful successful a resilient mode due to the fact that of the net risks that are retired there," helium said.

— Samantha Subin

Nasdaq concisely flashes red

The tech-heavy Nasdaq Composite concisely turned antagonistic for the day, bringing astatine 1 constituent each 3 of the large indexes into the red. It past came backmost up to 0.2%.

It's the lone of the 3 large indexes up arsenic traders look to the extremity of the 2nd hr of trading. The Dow is down 171 points, oregon 0.5%, aft antecedently moving down much than 200 points. The S&P 500 has dropped 0.2%.

Stocks person whipsawed implicit the people of the greeting arsenic investors weighed caller economical information that offers conflicting ideas astir the authorities of the economy.

— Alex Harring

Wayfair sees beardown vacation play income arsenic customers caller and aged turned up for bargains

All signs person been pointing to weak income of location furnishings aft consumers spent heavy successful the class during the pandemic. In caller days, companies similar Williams-Sonoma and RH person received downgrades.

However, Wayfair shares are up much than 6% successful premarket trading Wednesday aft reporting beardown five-day vacation play sales. From Thanksgiving to Cyber Monday, the institution saw a low-single digit income summation successful the U.S. compared with the aforesaid play past year.

The institution said repetition customers made up 73% of its orders during the vacation weekend, but it besides pulled successful caller shoppers. Sales besides strengthened starring into the vacation weekend.

The large question for retailers continues to beryllium what volition hap successful the weeks starring into Christmas. Bargain-hungry shoppers turned up successful grounds numbers for the large income but the full play volition hinge connected what happens implicit the adjacent fewer weeks.

-Christina Cheddar Berk

Job openings autumn somewhat successful October

Job openings fell successful October somewhat much than expected but remained good supra the fig of disposable workers, the Labor Department reported Wednesday.

The Job Openings and Labor Turnover Survey, a intimately watched indicator of employment slack, showed determination were 10.33 cardinal disposable positions for the month. That was somewhat beneath the FactSet estimation of 10.4 cardinal and down from 10.69 cardinal successful September.

There are present 1.7 occupation openings per disposable worker.

The quits level, an indicator of idiosyncratic confidence, fell somewhat to 4.03 million. The quits complaint arsenic a stock of the workforce decreased to 2.6%, a 0.1 percent constituent decline.

—Jeff Cox

Pending location income fell 4.6% successful October

Pending location sales, which reports signed contracts connected existing homes, fell 4.6% successful October, according to the National Association of Realtors. The scale fell for a 5th consecutive month.

The scale declined 10.2% successful the anterior period successful its lowest level since June 2010, excluding April 2020, which was during the onset of the pandemic.

— Sarah Min

S&P 500 level arsenic investors participate archetypal hr of trading

The S&P 500 was level arsenic trading kicked off.

The Dow, meanwhile, was somewhat down, having shed 49 points, oregon 0.15%.

The Nasdaq Composite, connected the different hand, climbed 0.4%.

— Alex Harring

Goldman Sachs expects these large takeaways from Powell speech

Federal Reserve Chairman Jerome Powell successful a code aboriginal Wednesday apt volition corroborate expectations of smaller complaint increases up portion besides signaling that he's inactive disquieted astir inflation, according to Goldman Sachs.

In a lawsuit enactment Wednesday morning, the Wall Street firm's economists outlined a fewer superior expectations erstwhile the cardinal slope person speaks astatine the Brookings Institution.

"Powell is apt to hint that the [Federal Open Market Committee] volition dilatory the gait of complaint hikes astatine the December gathering but propulsion backmost against the caller easing successful fiscal conditions with 2 hawkish counterpoints," Goldman economist Ronnie Walker wrote.

"First, Powell is apt to suggest that the FOMC volition request to rise the funds complaint to a higher highest than it projected astatine the September meeting, echoing his remarks astatine the November property league and pursuing akin comments from respective different FOMC members implicit the past fewer weeks," Walker added. "Second, helium is apt to stress that ostentation remains excessively precocious and the labour marketplace remains highly tight."

Goldman expects the Fed to rise its benchmark involvement complaint by 0.5 percent constituent successful December, followed by 3 successive hikes of 0.25 percent constituent earlier pausing.

The Powell code is owed astatine 1:30 p.m. ET. A question-and-answer league volition follow.

—Jeff Cox

New Addams Family amusement 'Wednesday' could assistance boost Netflix, according to Keybanc

The caller Addams Family amusement "Wednesday" is present Netflix's astir watched bid successful a week, with viewers logging 341 cardinal hours successful the archetypal week of its release, Keybanc says.

"Netflix's palmy motorboat of Wednesday … screens arsenic an incremental affirmative against alternatively underwhelming viewership for The Crown (consistent w/w declines) and perceived viewership contention from [the] World Cup," Keybanc Capital Markets expert Justin Patterson said.

Many investors person pointed to the declining viewership of "The Crown" arsenic an incremental hazard origin to Netflix's paid nett additions, peculiarly amid interest astir World Cup contention and a lighter contented slate, helium wrote successful a enactment Tuesday.

"We judge Wednesday's beardown commencement changes the conversation," Patterson said. "As such, we judge Wednesday's show implicit the adjacent fewer weeks volition beryllium highly tracked, some astatine the aggregate viewership level and state level."

Whether the show becomes a much meaningful thrust of gross additions remains to beryllium seen, astatine a minimum the occurrence of "Wednesday" and little viewership contention are positives for retention, helium added.

— Michelle Fox

Third-quarter GDP gets revised higher

The U.S. system grew astatine a somewhat faster gait successful the 3rd 4th than was antecedently reported, with third-quarter GDP enlargement being revised up to 2.9% from 2.6%.

To beryllium sure, Tiffany Wilding of Pimco noted there's a "bit of sound that you person to instrumentality into account, due to the fact that inventories and commercialized numbers tin evidently beryllium precise volatile."

"When you exclude those much volatile categories, maturation was really beauteous subpar," Wilding said.

— Fred Imbert

Stock futures emergence somewhat connected caller information showing backstage hiring fell

Stock futures saw a flimsy boost aft new information from processing steadfast ADP showed backstage hiring sharply fell successful November.

Companies added conscionable 127,000 positions for the month, a notable driblet from the 239,000 the steadfast reported for October and the smallest summation since January. That came successful beneath the Dow Jones estimation of 190,000 for the month.

Investors could instrumentality the information arsenic a motion that the system is tightening – thing to cheer for those hoping it could power the Fed to dilatory oregon halt involvement complaint hikes arsenic they turn progressively acrophobic astir the interaction of an incoming recession connected the banal market.

— Alex Harring, Jeff Cox

Stocks making the biggest moves successful the pre-market

These are the stocks making the biggest moves earlier the bell:

Hormel – The nutrient producer's banal slid 6.4% successful the premarket aft reporting a mixed quarter. Earnings bushed estimates, but income came up abbreviated of Wall Street forecasts. The institution besides issued a weaker-than-expected outlook and said it expected a continued volatile and precocious outgo environment.

Petco – Petco rallied 8% aft its study of adjusted quarterly net of 16 cents per stock matched Street forecasts and gross was somewhat supra estimates. A comparable store income emergence of 4.1% bushed the FactSet statement estimate.

CrowdStrike – The banal plunged 17.6% successful the premarket aft the cybersecurity company's subscription numbers came successful beneath expert forecasts. Though it reported better-than-expected nett and gross for its latest quarter, the institution noted economical uncertainty is prompting customers to hold spending.

—Peter Schacknow, Alex Harring

Amazon has astir downside among megacap net stocks, Jefferies says

Another ample diminution for stocks could beryllium peculiarly achy for Amazon investors, according to Jefferies.

In a enactment to clients connected Tuesday night, expert Brent Thill examined the carnivore lawsuit scenarios for ample net and bundle stocks and recovered Amazon to beryllium the astir exposed successful specified a situation.

"We judge that AMZN has the astir downside successful our mega-cap sum fixed its vulnerability to inflationary outgo headwinds and a imaginable interaction from slowing consumption. We amusement that a carnivore lawsuit script of $60B successful EBITDA astatine a 9x trough aggregate would output a $51 dollar stock, oregon ~45% downside from existent levels," Thill said.

On the different hand, Microsoft was the "most insulated" by Jefferies' calculations, with lone 27% downside successful a carnivore lawsuit scenario.

Jefferies has a bargain standing connected some stocks.

—Jesse Pound, Michael Bloom

Elon Musk says Fed indispensable chopped rates instantly to debar terrible recession

Bitcoin, Ether connected way to station worst period since June

Bitcoin and Ether are each poised to marque November the worst months since June arsenic uncertainty implicit cryptocurrencies mounts.

Bitcoin is down 17.2% compared with the commencement of the month. If that stays erstwhile markets adjacent Wednesday, it would beryllium the worst show since it dropped 40.3% implicit the people of June.

Ether is slated to extremity the period down 19%, which would besides beryllium the biggest mislaid since June's 47.4% drop.

The slides travel arsenic investors turn progressively wary of crypto following the illness of speech FTX.

— Gina Francolla, Alex Harring

Euro portion ostentation drops, fueling hopes of ECB complaint hike slowdown

Euro portion ostentation dropped by much than expected successful November, fueling marketplace hopes that record-high terms maturation crossed the bloc has peaked and the European Central Bank volition statesman slowing its involvement complaint hikes adjacent month.

The user terms scale grew by 10% year-on-year, down from 10.6% successful October and comfortably beneath a statement projection of 10.4% successful a Reuters canvass of analysts.

However, nutrient terms inflation, a cardinal interest for policymakers, continued to accelerate, with falling vigor prices accounting for the bulk of the slowdown.

- Elliot Smith

European markets higher arsenic investors way euro portion ostentation data

European markets were cautiously higher connected Wednesday arsenic determination investors monitored the latest ostentation information from the euro portion successful November.

The pan-European Stoxx 600 was up 0.8% successful aboriginal trade, with autos adding 1.8% to pb gains arsenic each sectors and large bourses entered affirmative territory.

Elsewhere overnight, Asia-Pacific shares were mostly higher connected Wednesday adjacent arsenic the speechmaking for China's November mill activity fell abbreviated of expectations, dropping to the lowest speechmaking since April.

- Elliot Smith

Yield curve inversion betwixt 2Y/10Y Treasuries widened Tuesday

A cardinal portion of the output curve intimately watched by Wall Street investors and analysts alike inverted further connected Tuesday, perchance signaling a recession ahead.

The output connected the 10-year U.S. Treasury ticked up astir 4 ground points to commercialized astatine 3.752% connected Tuesday. At the aforesaid time, the two-year output roseate somewhat to 4.481%. Yields determination inverse to price, and a ground constituent is adjacent to 0.01%.

The quality betwixt yields, called the output curve, is simply a recession awesome erstwhile investors are getting amended payback for snapping up shorter-term bonds than longer word ones. Currently, the dispersed betwixt the 10-year and 2-year Treasury bonds is much than 73 ground points, the widest successful decades.

What this inversion signals is that the Fed whitethorn person tamed ostentation capable to chill down the system and whitethorn beryllium capable to intermission oregon pivot soon. It tin besides beryllium work arsenic a motion that a recession is connected the horizon.

—Carmen Reinicke

ADP jobs report, JOLTS rolling retired Wednesday

Two reports issued connected Wednesday should springiness investors immoderate penetration into the authorities of the U.S. labour marketplace successful beforehand of Friday's large payrolls report.

The ADP jobs speechmaking is owed Wednesday astatine 8:15 a.m. ET. Economists polled by Dow Jones expect that backstage employers grew their payrolls by 190,000 positions successful November, a diminution from October's summation of 239,000.

At 10 a.m., the U.S. Bureau of Labor Statistics volition contented the results of the Job Openings and Labor Turnover Survey (JOLTS). FactSet estimates that determination were 10.4 cardinal occupation openings successful October. Back successful September, employment openings totaled 10.7 million.

Fed policymakers support a adjacent oculus connected the JOLTS report, searching for clues connected the authorities of the labour marketplace and whether it needs further cooling.

The main lawsuit successful economical information this week volition beryllium the November nonfarm payrolls report, owed Friday astatine 8:30 a.m. Dow Jones expects that payrolls grew by 200,000, which is down from October's summation of 261,000. Economists are besides calling for the unemployment complaint to clasp dependable from the anterior period astatine 3.7%.

-Darla Mercado

CrowdStrike, NetApp slump successful aft hours trading

A fewer stocks plunged successful aft hours trading Tuesday aft releasing net results that fell abbreviated of Wall Street's expectations.

CrowdStrike — CrowdStrike Holdings plunged much than 18% aft giving airy guidance for fourth-quarter revenue, adjacent though its net results topped Wall Street estimates.

NetApp — NetApp banal fell 10.8% aft unreality services and information absorption supplier saw weaker-than-expected gross successful its latest quarter. NetApp reported adjusted net per stock of $1.48, beating estimates of $1.33. But its gross of $1.66 cardinal fell abbreviated of the $1.68 cardinal Wall Street anticipated, per Refinitiv. NetApp besides issued anemic guardant guidance.

Read much astir banal moves here.

—Carmen Reinicke

Stock futures unfastened small changed Tuesday evening

Stock futures were small changed Tuesday evening arsenic Wall Street awaits a Wednesday code from Federal Reserve Chair Jerome Powell that whitethorn springiness further penetration into aboriginal complaint hikes.

Futures tied to the Dow Jones Industrial Average roseate 1 point, oregon 0.003%. S&P 500 futures and Nasdaq 100 futures slipped 0.03% and 0.08%, respectively.

—Carmen Reinicke

1 year ago

49

1 year ago

49

English (US)

English (US)