Image source, Reuters

Image source, Reuters

The authorities is nether unit to reverse changes to corp tax, which were announced successful the mini-Budget little than a period ago.

What is the taxation and however mightiness it change?

How overmuch is corp taxation and who pays it?

Corporation taxation is paid to the authorities by UK companies and overseas companies with UK offices.

They are presently charged 19% of their profits. Profits are the magnitude of wealth a institution makes, minus immoderate wealth it has spent.

Since 2015 determination has been a azygous complaint of corp tax. Before then, determination was a main complaint and a little complaint for companies with profits nether £300,000 a year.

The complaint of corp taxation was chopped rapidly by the Conservatives - from 28% erstwhile the enactment came to powerfulness successful 2010, to 19% successful April 2017.

What is happening to corp tax?

Former chancellor Rishi Sunak announced successful March 2021 that the complaint of corp taxation was going up. It was owed to emergence from 19% to 25% successful April 2023.

He said it was just to inquire companies to lend much aft the authorities spent billions of pounds supporting them during the Covid pandemic.

However, during the Tory enactment run Liz Truss pledged to reverse Mr Sunak's decision. She said: "I deliberation it's vitally important that we're attracting concern into our country."

On 23 September, past Chancellor Kwasi Kwarteng announced that corp taxation would so enactment astatine 19%.

The authorities estimated keeping corp taxation astatine 19% would outgo £19bn a twelvemonth by 2026-27. However, that forecast has not had the accustomed checks by the autarkic Office for Budget Responsibility (OBR) - which provides economical proposal to the government.

The grade of the unfunded taxation cuts announced successful the mini-budget - which besides included changes to National Insurance and the apical complaint of taxation - caused problems connected fiscal markets.

The outgo of borrowing for the authorities and for mortgages some roseate considerably and the lb fell against the dollar.

As a result, the authorities is present nether unit to reverse immoderate of its decisions - including those connected corp tax.

Would lowering corp taxation assistance the economy?

The £19bn outgo doesn't instrumentality into relationship immoderate other wealth made by the authorities if firms marque higher profits.

The thought of cancelling the summation was that it would promote much companies to travel to the UK and put much money.

It was hoped the system would turn and the authorities would person much wealth adjacent though the taxation complaint was lower.

However, economical deliberation vessel the Institute for Fiscal Studies said that effect would not beryllium capable for the taxation cuts to wage for themselves.

What bash different countries do?

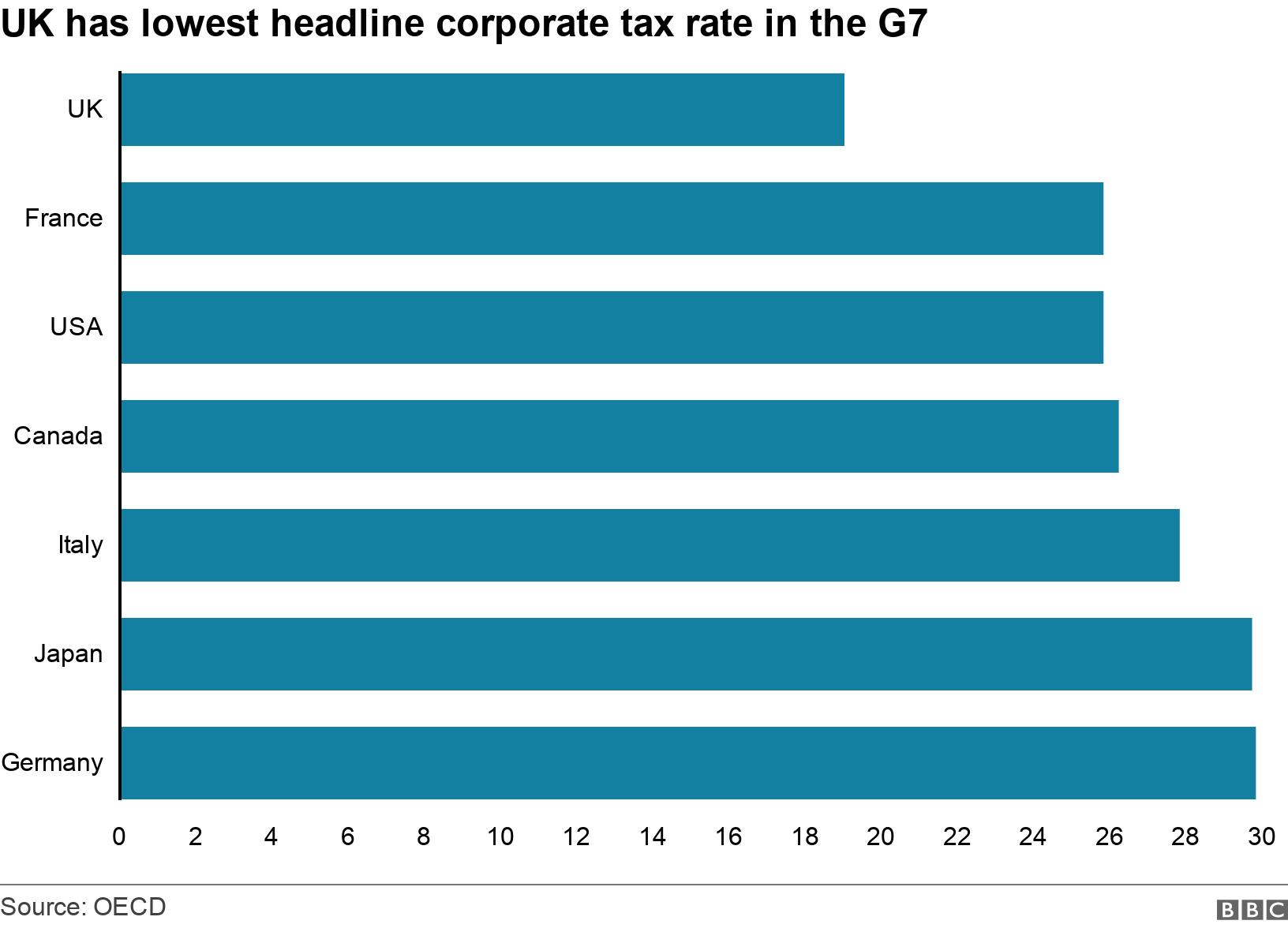

The authorities says that keeping the corp taxation complaint astatine 19% volition mean it is "significantly little than G7 counterparts".

The G7 is simply a radical of countries with big, industrialised economies.

The adjacent lowest state for corp taxation is France astatine 25.8% - higher than the UK adjacent if the summation had gone up successful April.

But this illustration doesn't archer the afloat story.

Governments permission loopholes. Companies whitethorn wage little tax, if they put successful their businesses for example, oregon acceptable up successful definite parts of a country.

So the taxes that companies wage tin look precise antithetic to the header rates of taxation charged.

2 years ago

69

2 years ago

69

English (US)

English (US)